From Ignored to Indispensable: The Proven, Step-by-Step CX Insights Mastery Blueprint in < 6 Days! Get free access>

Each month, Thematic hosts a virtual roundtable for insights professionals within our community. Together, we discuss how we’re seeing this space evolving and swap notes on best practices! Join our community here.

We’ve been digging into this concept of “insights maturity” at Thematic for some time now. So, this month, we brought this subject to the group to be discussed in our roundtable.

A maturity model is used as a measurement of a company’s continuous improvement in a field. We’ve seen models for customer experience, but we’ve never seen a model specifically for customer feedback analysis.

We thought it would be very useful for insights professionals and companies alike to be able to map themselves against a customer feedback analysis maturity model. A model of this nature can be very useful for finding clarity around where you are currently at, and where you would like to be. And then identifying and planning to resolve roadblocks to achieving further maturity.

We wanted to get an untainted idea of where insights professionals were at on their journey to feedback analysis maturity. So without context we shared only the headings to the 5 stages of our model.

We then asked everyone to plot themselves against these stages.

Our goal here is to create a robust model - built on what our community members are experiencing.

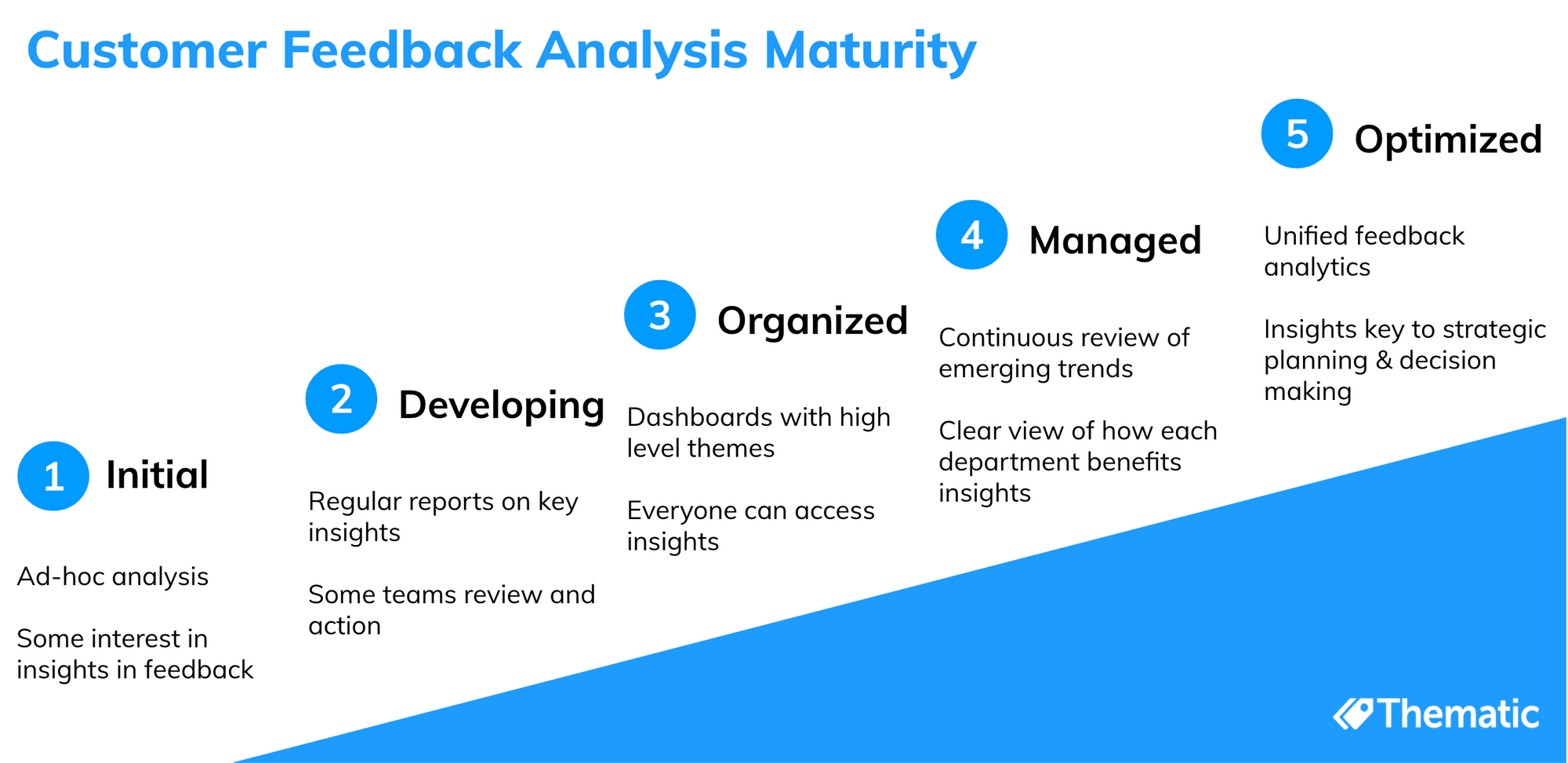

Here was our starter view:

Based just on these stage labels, most people on the call ranked themselves between 2 - 5. This would later change, after the community shifted the definition of what the model was describing and the criteria for the different stages.

We also discussed how companies can be at multiple different stages, based on how various business functions or projects are being treated. For example, some insights teams may be at an optimised feedback stage (5) running, but overall, the organisation’s use of feedback may be between stages 2-3.

As one member said, “It’s a mammoth task for some businesses - with a lot of the planning that has to be done first. It can slow you down”.

Equally, one member made the astute comment that “getting the team to the Managed stage is really just the end of phase one”. Desmond McGuirk, CEO of CFS Australasia brought up what’s happened across the Australian healthcare sector over the past year to the discussion. Some service providers there have sophisticated systems in place (driven by compliance obligations) but are now beginning to see how much data and feedback they’re missing out on. They’re ticking all the boxes from a systems point of view. But in terms of how they respond to changes with their customers and in the market, there’s still a steep learning curve being faced.

When working on the client-side, consultants agreed that understanding both what stage organisations are at, and where the ambitions are for that business, can drastically change the sophistication of the insights work you do with clients.

Now we had a good idea of where people believed they were at, we shared some definitions of the different maturity stages that we created.

Initial: Research is still being conducted in an ad-hoc manner, and companies are laying the data collection foundations.

Developing: Organisations are able to increase the frequency of their reporting - and therefore can start using comparable statistics.

Organised: Organisations are able to communicate these insights to wider stakeholders and provide decision-makers with a deeper level of insight.

Managed: When data is organised in a way to consistently build and find emerging themes in feedback, and demonstrate trends that aid future decision-making.

Optimised: When a number of different metrics are being used to understand feedback - and organisations can use the data to understand what is causing changes to metrics (such as NPS). There can be clear linkages between what impact the changes they’re making are having. Data is unified, and no longer siloed.

After revealing these definitions a lot of community members who rated themselves between a 3-5, suddenly realized they were at stage 2, or even 1.

As a group, we discussed whether this demonstrates an aligned view of the “maturity” curve. It was about this stage of the conversation that the true theme of this month came to fruition:

It’s all about how the feedback is being used - and by who.

There was general consensus that maturity goes far beyond the operational success and methodologies insights teams are able to apply. As one member put it “If what you’re doing is detached from the Executive team, that often means you have further to go - despite your model looking mature”

People reinforced this a number of times:

“To what degree is the feedback baked into strategic planning for the organisation?”

“How is it supporting the prioritisation of decisions - and being the driver behind decisions?”

“Is there buy-in with the right stakeholders?”

“Can the right people get the depth of insights they need, at the right time?”

In general, beyond stage 3, the community’s view is that the focus shifts beyond our customer feedback capabilities, and settles into the “strategic advisory” space.

Here’s where it can get tricky though. If you’re pushing for change further up the chain, you need confidence in the knowledge being shared. When you share feedback insights, you need to feel empowered with what you’re sharing and understand the implications for decision-makers.

Dale McCarter, Insights Manager for Xero, highlighted relevance. As in, our ability to understand how the business (and individual roles within it) can use the data to make an impact.

In a perfect world, the work you’re doing will become a core business KPI. Not having this Executive buy-in can be a massive roadblock to maturity.

We need to be confident talking about what the data actually means - and help individuals understand what influence their role has in changing what’s happening.

Kay Bramley (Senior Insights Manager at Goodman Fielder) discussed her role at a previous employment and the high customer feedback maturity exhibited there. The high feedback maturity rating of this company came down to the amount, the frequency and the distribution of the insights shared throughout the business.

In this instance, it was driven by the highly competitive environment the business was in - and the need for improvements to be made from the bottom-up.

This took us to a discussion about the work Thematic has been doing with Atom Bank - a great example of the other side of the coin: a top-down insight-driven company. The team there have accumulated all their feedback channels to create one key performance metric - and everything in the bank orientated around this.

So, if we were to construct a progressive view of what “maturity” looks like… what would that entail?

...Or achieve “Insights Excellence” - as one community member put it.

It comes down to delivering a more holistic view of what’s going on with the customer and the business. Being able to integrate your different data sources to give a full picture of your customer experience (read: What is Unified Data Analytics?). Then being able to demonstrate themes, the corresponding impact - and giving individuals throughout the organisation ongoing education about how what they’re doing can impact CX.

The good news is - by building this kind of insights excellence maturity model , we can all understand where we are on the journey and decisively plan how we’re going to process to the next stage.

Our insights excellence, or customer feedback analysis, maturity model is still a work in progress, and our community is helping us build it. Once complete we plan to release the maturity model in a white paper.

If you’re interested in getting involved, please express your interest or ideas here! We’d love to hear what you think.

Join the newsletter to receive the latest updates in your inbox.

Transforming customer feedback with AI holds immense potential, but many organizations stumble into unexpected challenges.