From Ignored to Indispensable: The Proven, Step-by-Step CX Insights Mastery Blueprint in < 6 Days! Get free access>

Getting CX buy-in and commitment for CX initiatives from executive leaders is key when it comes to driving real results for customers, but many CX leaders struggle with this.

We surveyed 150 CX professionals to learn about their current role and situation: Are they getting buy-in in their organization? Which strategies have they tried that worked to secure CX buy-in and which didn’t?

This report describes the survey itself, its respondents and provides a deep-dive into the answers.

Over the course of Fall 2019, we surveyed 150 CX professionals. The survey itself was conducted by Thematic, in collaboration with the Customer Experience Professionals Association (CXPA), and publicized through our social media, CXPA and our friends & influencers in CX space, such as Annette Franz and Maurice FitzGerald.

Instead of coming up with multiple-choice questions about possible drivers, we used one simple rating question and two open-ended questions as the core of the survey, with the goal of finding nuggets of knowledge that we would otherwise miss.

First, we asked to rate the level of buy-in among the executives:

The two open-ended questions were:

We also asked a series of close-ended questions about the respondents such as:

At the end of the survey, we run optional rating questions:

Let’s start by looking closely at the 150 professionals who responded.

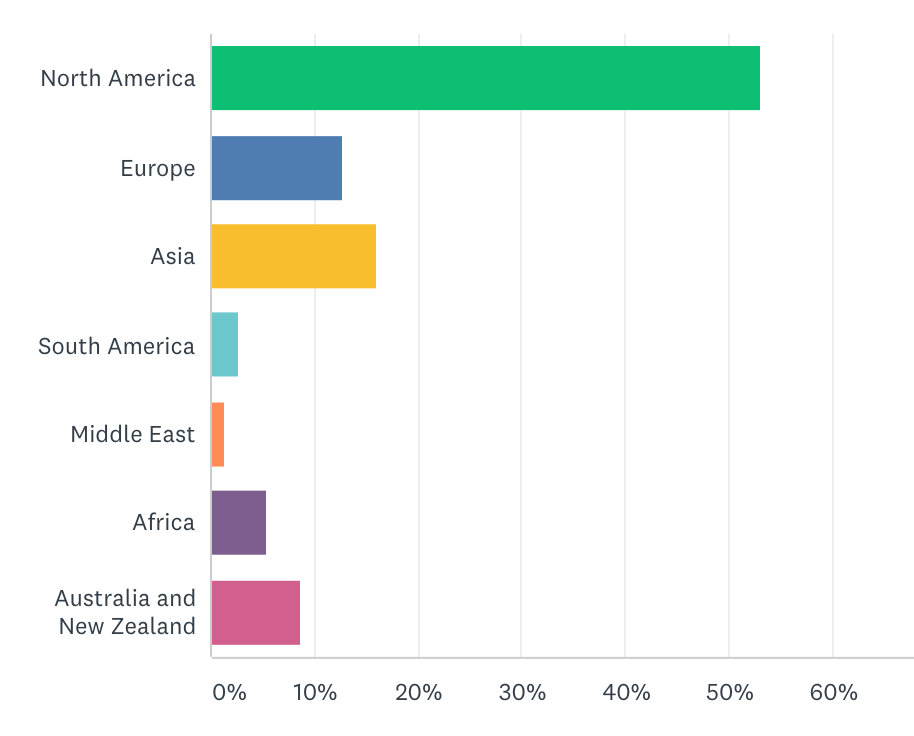

The majority were located in North America:

People’s answers to the question “Where are you located?”

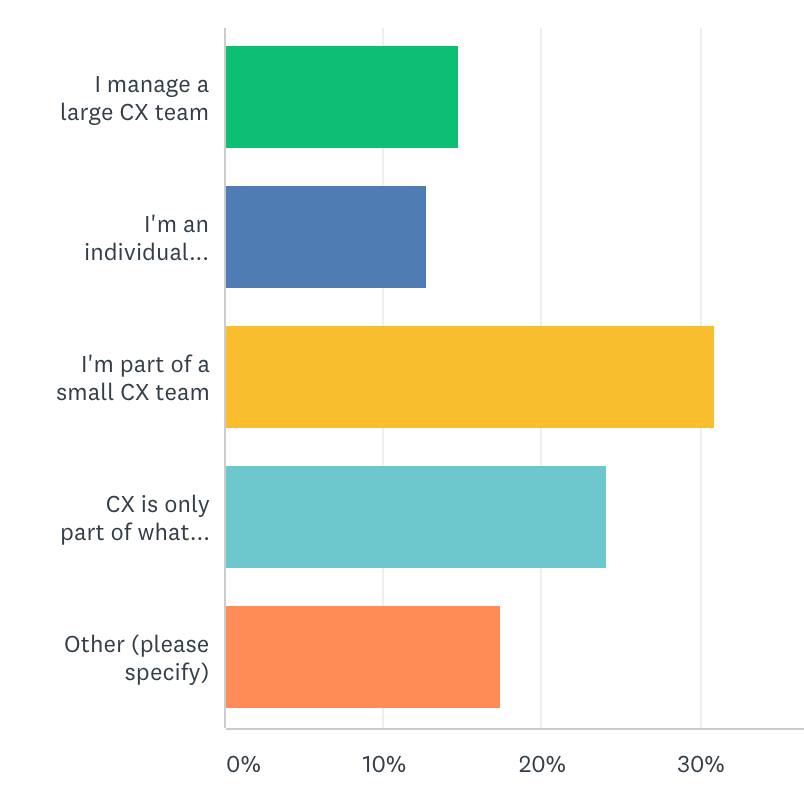

The majority are working in a CX team and only for 23% CX is only a part of what they do.

People’s answers to the question “What is the nature of your current role?”

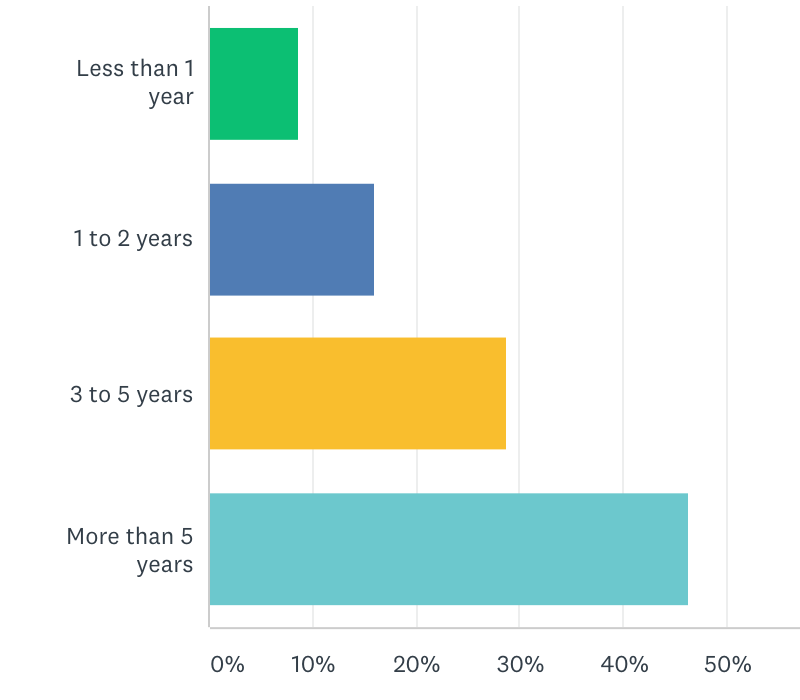

The majority of respondents, 75%, have worked in CX for at least 3 years. Around 45% worked in CX for more than 5 years.

People’s answers to the question “How long have you been working in CX?”

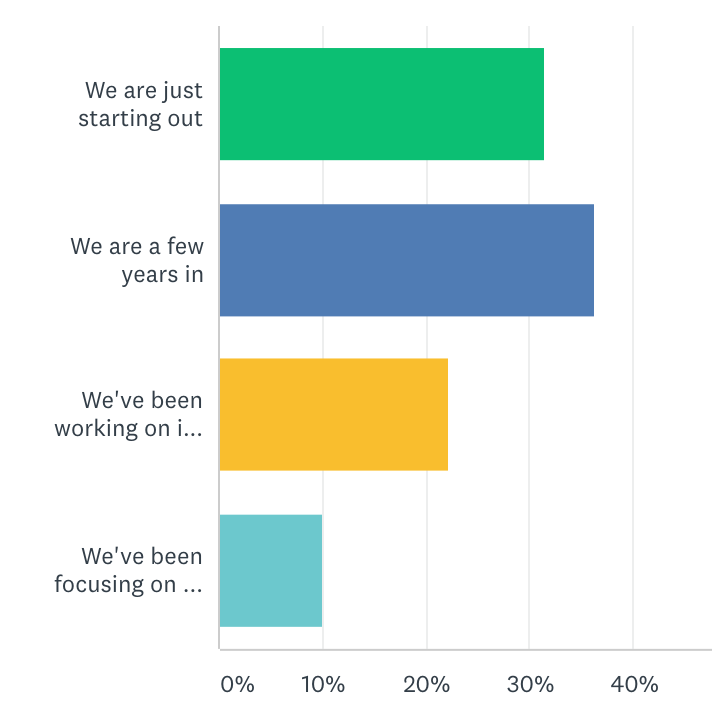

When it came to the company itself, only just over 30% were just starting out. All others are either a few years in, or have been working on CX for the past 5 years or longer.

People’s answers to the question “How long has your company been focused on CX?”

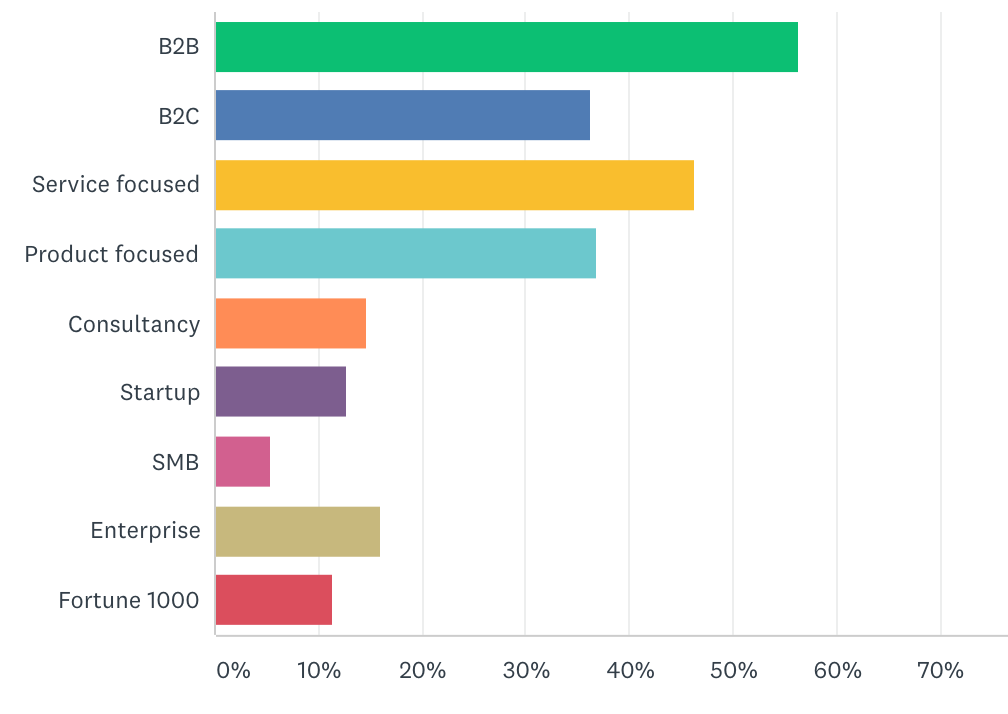

When it came to attributes that describe the companies of the respondents, we observed over 50% of companies working in B2B, and less in B2C space, with slightly more Service than Product focused organizations.

People’s answers to the question “What are some attributes that describe your company?”

Now that we reviewed the types of respondents to this survey, let’s look at the answers to the core questions: level of buy-in, winning strategies and hurdles.

To rehash, the question was “How would you rate the level of buy-in among your executive stakeholders?”. The majority of respondents selected “Average. It depends on the situation”. Almost a quarter, 35 people, believe that their buy-in is poor or extremely poor. And a third, 50 people, believe that it’s above average.

| ❚ Extremely poor: Everything is a battle |

| ❚ Poor |

| ❚ Average: It depends on the situation |

| ❚ Good |

| ❚ Excellent: My executives are fully on board. My work leads to clear CX improvements |

Answers to the question “How would you rate the level of buy-in among your executive stakeholders”

The overall rating for the level of buy-in is 3.1. By segmenting the respondents by their attributes described in section 2, we can learn which attributes are associated with higher scores, and which ones are associated with lower scores.

| More likely to have higher buy-in | Average buy-in | More likely to have lower buy-in |

| -North America -Consultancy -Startup -SMB -Respondent is more than 5 years in CX -Company focused on CX for a while or longer | -B2C, B2B -Respondent is less than 5 years in CX | -Outside of North America -Enterprise -Company is just starting out in CX |

This is interesting because getting buy-in is the number one issue for CX professionals. The above attributes signal the kinds of jobs that will be more satisfying.

Responses to the rating questions we asked at the end revealed additional associations:

| Rating of 4 or 5 | Rating of 3 | Rating of 1 or 2 | |

| To what extent has your executive team bought into in a CX metric or set of metrics? | 3.6 | 3.1 | 2.8 |

| How extensively are your CX metrics tied to financial metrics at your company? | 3.5 | 3.2 | 2.6 |

| To what extent do you tie open-ended customer feedback to your CX metrics? | 3.5 | 3.1 | 2.9 |

| Do your stakeholders ever dismiss customer feedback insights or reports as anecdotal? | 3.7 | 3.1 | 2.5 |

Average level of buy-in, depending on the answers to 4 rating questions, describing common behaviours and situations in organizations.

Each respondent answered the open-ended question: What have you found to be most effective in securing buy-in from stakeholders?

We have coded each response according to one or more themes and sub-themes using Thematic’s AI-powered coding software.

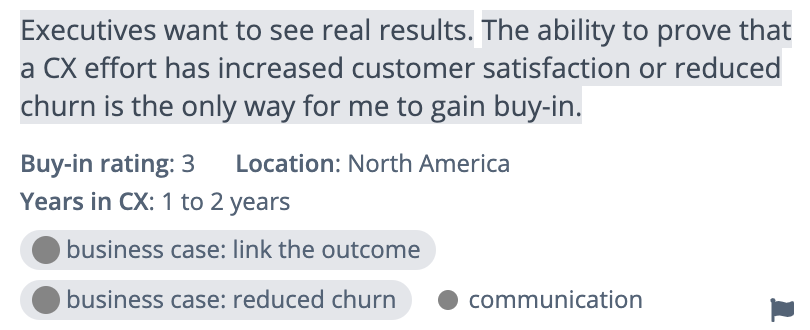

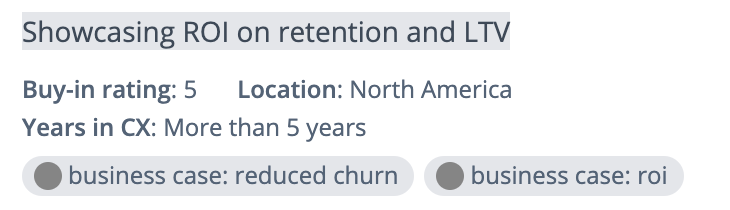

Here are two sample answers to this question and how they have been coded.

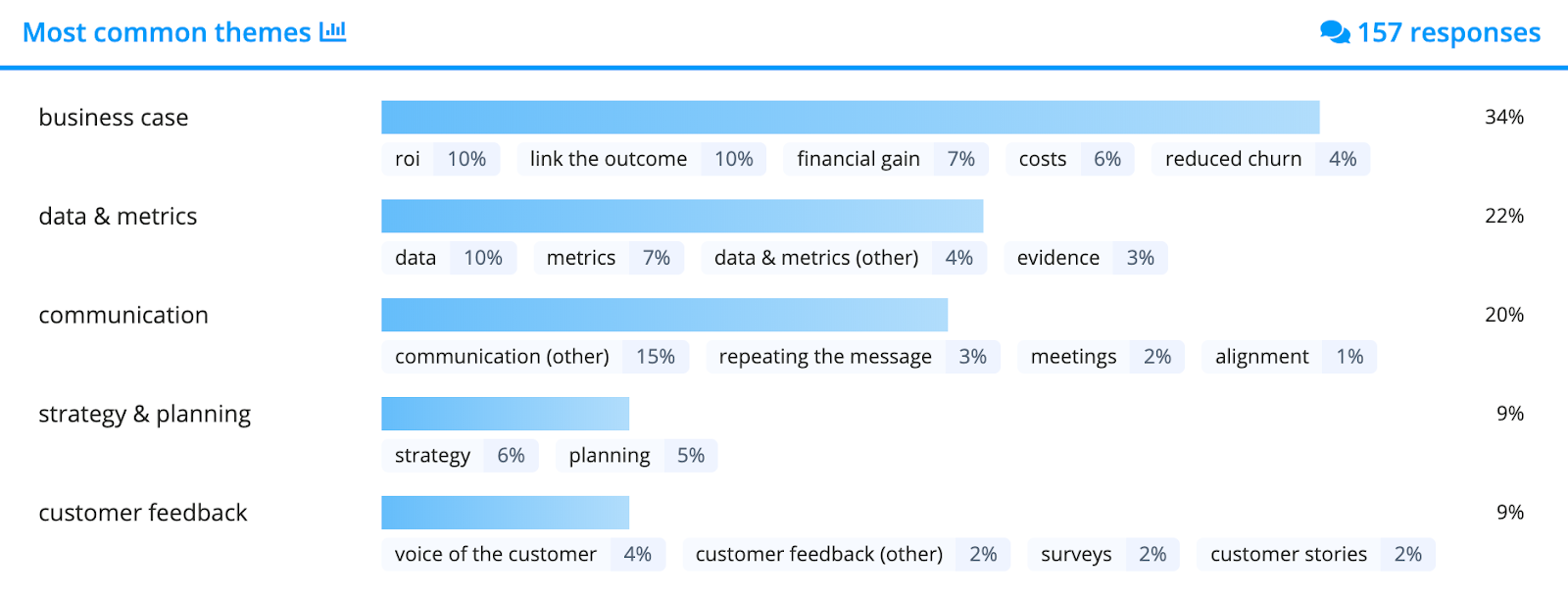

Here is the distribution of major themes and more specific sub-themes across all responses to this question:

Answers to the question “What have you found to be most effective in securing buy-in from stakeholders?”

Below we dig deeper into the insights gained from segmenting the data by buy-in level.

Each respondent answered the open-ended question: What obstacles have prevented you from securing buy-in from stakeholders?

Just like in 3.2, we have coded each response according to one or more themes and sub-themes using Thematic’s AI-powered coding software.

Here are two sample answers to this question and how they have been coded.

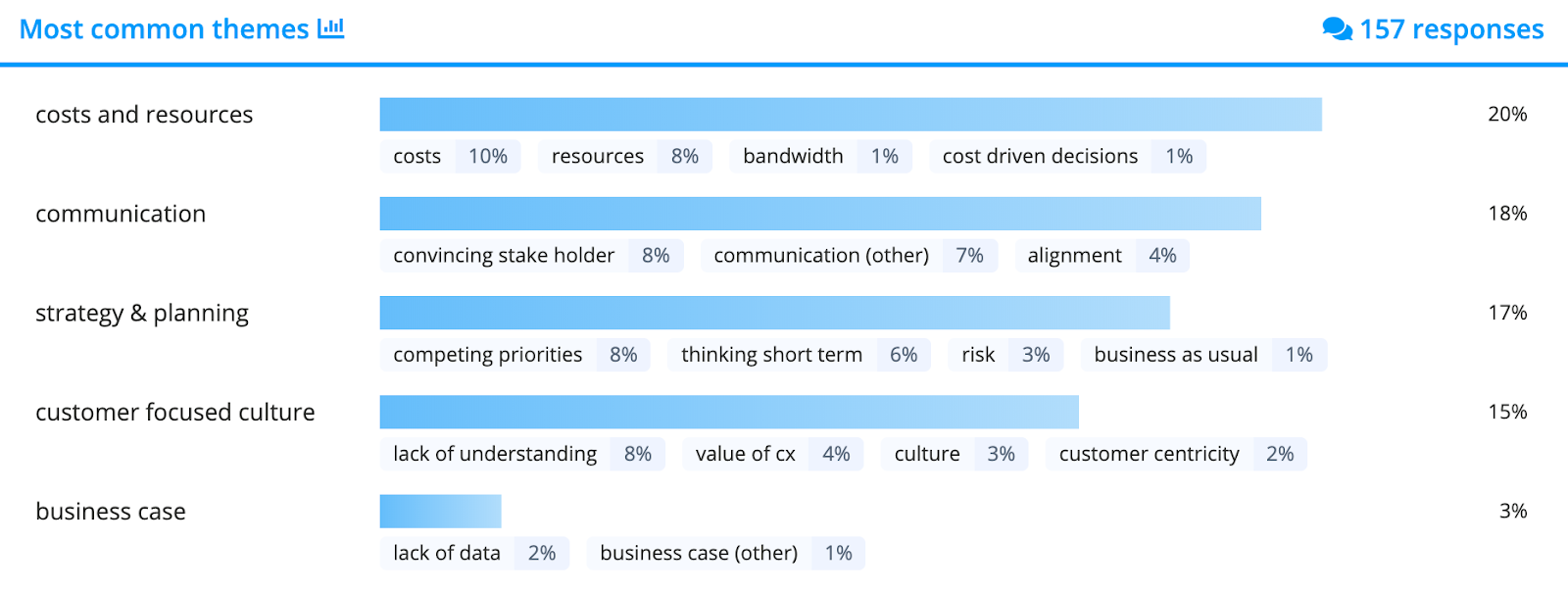

Here is the distribution of major themes and more specific sub-themes across all responses to this question:

Answers to the question “What obstacles have prevented you from securing buy-in from stakeholders?”

Below we dig deeper into the insights gained from segmenting the data by buy-in level.

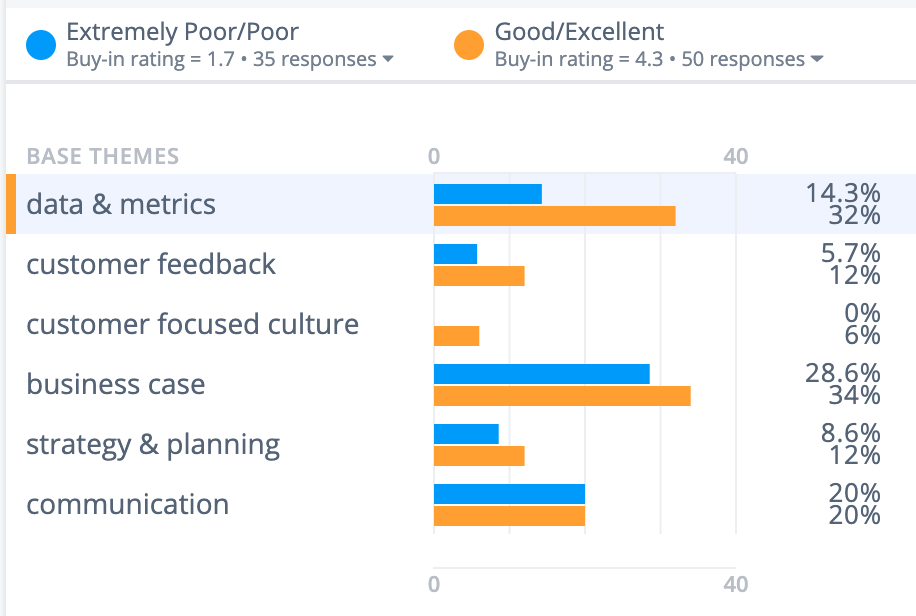

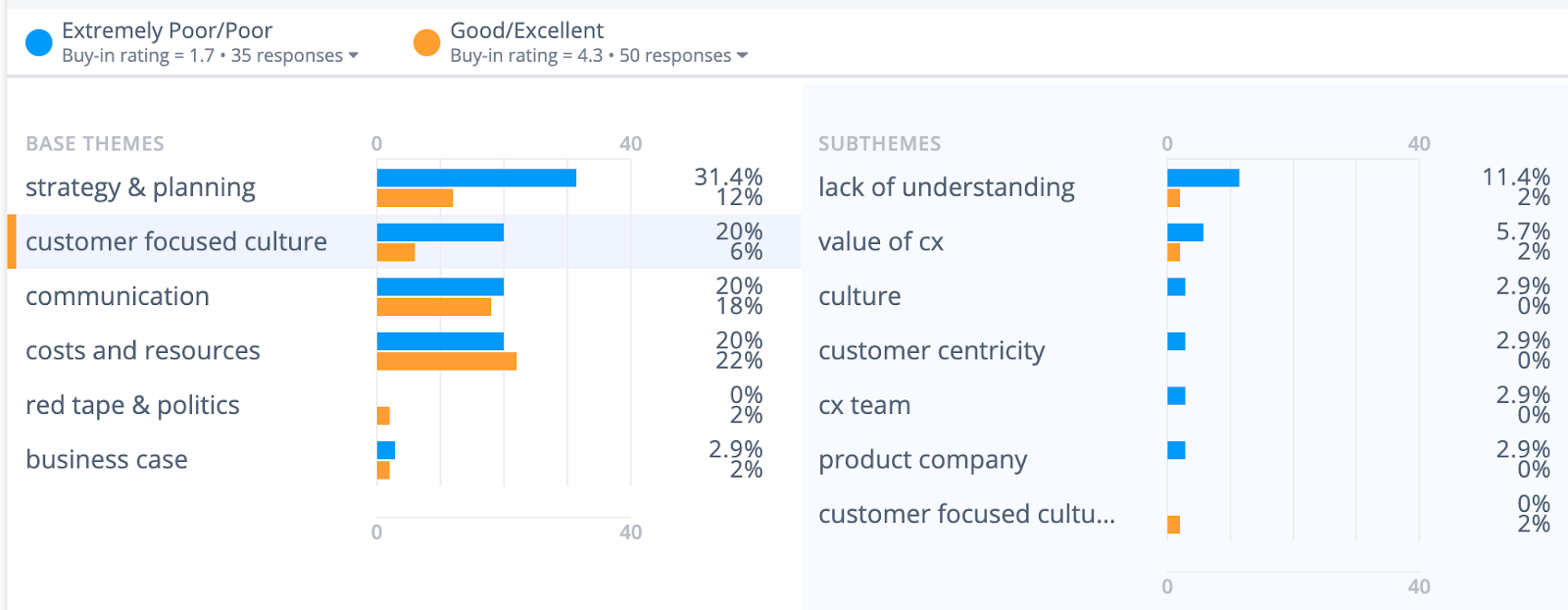

It’s interesting to compare two groups of respondents: Those who report good or excellent level of buy-in (50 people, with an average buy-in rating of 4.3), and those who don’t (35 people, with an average buy-in rating of 1.7).

Are there differences in the strategies referred to as winning ones?

Here, we compare the responses by these two segments in Thematic’s Explore tool, which sorts themes among the “most effective strategies” by the greatest difference in volume between the two groups:

Themes by volume across two segments who answered the question

“What have you found to be most effective in securing CX buy-in from stakeholders?”

Both groups mentioned communication and making a business case as keys to securing executive buy-in. But practitioners reporting above average levels of executive buy-in were:

They are also non-surprisingly mentioning customer-focused culture of their organizations.

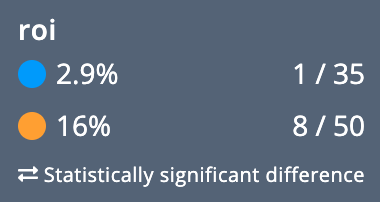

But the greatest difference between the two segments is the focus on ROI for the organization:

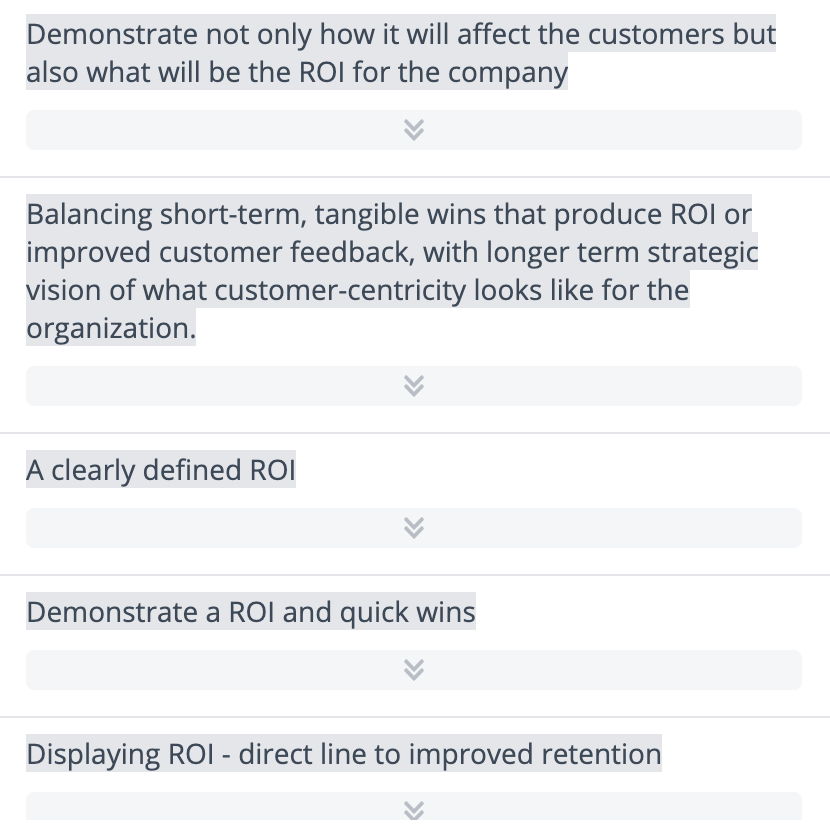

So, how does one prove the ROI of CX?

We have written an article on this topic recently, which includes not just the rationale behind it but also a clear guide and a spreadsheet to model the ROI using internal numbers, such as the number of customers, their spend and a popular CX metric Net Promoter Score.

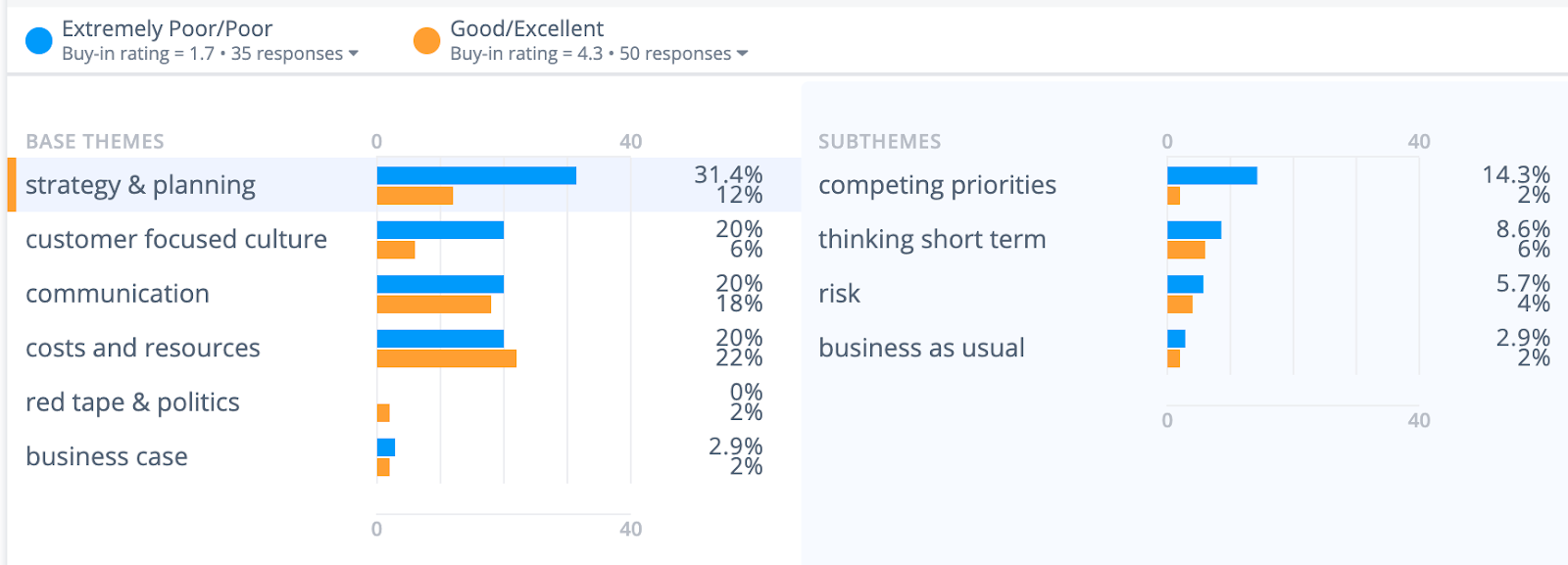

Are there differences in the obstacles encountered by the winning ones?

There are!

Everyone struggles with costs & resources.

But practitioners reporting below average levels of CX buy-in are:

– 60% more likely to list strategy and planning

– 3x as likely to list customer focused company & culture

– More likely to list communication

The greatest difference is in the strategy of the company, that often cites “competing priorities” as the main reason for not embarking on a CX journey:

The second greatest difference is the lack of understanding of the value of CX in a company that isn’t as focused on the customers due to its culture:

It is clear from the survey data that simply making a business case for CX initiatives isn’t enough to generate the kind of buy-in and commitment that CX leaders need.

By proving the ROI of CX with hard data, and incorporating customer feedback into stakeholder communications, CX leaders can move past struggling to secure CX buy-in, to winning the kind of commitment to the customer that will make a difference.

At Thematic, we use customer feedback to do just that. Our AI-powered platform gives CX leaders the tools to turn qualitative customer feedback into quantified insights that map to metrics that executives care about. Click HERE to learn how we do it.

Join the newsletter to receive the latest updates in your inbox.

Transforming customer feedback with AI holds immense potential, but many organizations stumble into unexpected challenges.