Reduce Customer Churn with the Voice of the Customer (VoC)

A focus on customer acquisition often overshadows the vital task of retention.

A shocking 66% of consumers end relationships with companies due to poor customer service. This highlights a disconnect: Customers crave positive experiences, yet businesses sometimes must listen proactively.

The consequence? Churn – lost revenue, tarnished reputation, and wasted effort. The good news is that churn isn't inevitable. Voice of the Customer (VoC) empowers you to shift from reactive to proactive, identifying those at risk of leaving before it's too late.

Understanding the "why" behind potential churn can improve the overall customer experience (CX) and safeguard your bottom line.

What is customer churn?

Customer churn refers to the percentage of customers who stop doing business with a company within a given period. It's a critical metric for businesses of all sizes, directly impacting revenue, reputation, and overall growth. There are two main types of churn:

- Voluntary Churn: The customer actively leaves due to poor experiences, better competitor offerings, or changing needs.

- Involuntary Churn: The customer leaves due to circumstances beyond their control, such as non-payment or the customer relocating to an area where your service cannot reach.

Poor Customer Experiences Increase Customer Churn

Customer churn is often a direct consequence of negative customer experiences. Think of churn as a final symptom indicating an underlying problem. Here's how poor experiences often fuel customer churn:

- Unmet Expectations: When customers' expectations for your product, service, or support aren't met, they become disillusioned and more likely to seek alternatives.

- Frustrating Interactions: Difficult website navigation, unresolved support issues, or unhelpful interactions with staff contribute to customer frustration and erode loyalty.

- Feeling Unappreciated: Customers who feel they need to be more valued or believe their feedback is ignored are likelier to churn.

While poor experiences are a major driver of churn, other factors can also play a role, such as changes in customer needs, pricing shifts, or aggressive competitor tactics.

Voice of the Customer (VoC) data is your most powerful tool for uncovering the reasons behind customer churn. You gain insights beyond churn numbers by systematically collecting and analyzing customer feedback from various sources (surveys, reviews, social media, website interactions, and support tickets).

Voice of the Customer data pinpoints recurring frustrations, unresolved pain points, and unmet expectations that ultimately fuel customer churn. Analyzing this data helps you identify the specific areas where customer experience is faltering, empowering you to take targeted action to prevent customers from leaving in the future.

5 Reasons Why You Need To Reduce Customer Churn by Improving Customer Experiences

Here's why reducing customer churn is a non-negotiable for customer-focused businesses.

1. Proactive vs. Reactive Customer Retention

Without a churn risk model, your approach to customer retention remains reactive. You might notice a spike in churn and scramble to investigate the cause, but by then, it's often too late to retain those customers. A churn risk model empowers you to shift from reactive to proactive by identifying at-risk customers early, allowing you to intervene before they leave.

2. Targeted Action for Maximum Impact

Not all customers leave for the same reasons, and generic retention strategies are rarely effective. A churn risk model, informed by your specific data, allows you to personalize interventions.

For example, you might focus on:

- Proactive support for customers frustrated by a particular product feature

- Targeted offers to customers showing signs of declining engagement

- Personalized onboarding to address common pain points for new customers

3. Resource Optimization

Attempting to improve every customer's experience can be expensive and time-consuming. A churn risk model guides you toward the right actions with the most significant impact. You can focus your resources on those customers most likely to leave, preventing lost revenue and preserving your investment in acquiring those customers.

4. Data-Driven Decision Making

Intuition can be misleading when it comes to customer churn. A churn risk model empowers you to make informed, data-driven decisions. By analyzing the data and identifying the factors that contribute to customer churn, you can:

- Prioritize product or experience improvements that address the root causes of dissatisfaction

- Evaluate the effectiveness of retention campaigns and adjust strategies based on insights

- Reduce operational and service costs for managing upset customers

5. A Competitive Advantage

Companies that actively manage their churn risk demonstrate a commitment to customer experience. This focus on customer-centricity builds trust and loyalty, making you stand out in a competitive marketplace. Investing in a churn risk model shows you're dedicated to truly understanding your customers and continuously improving their experiences.

7 Steps to Reduce Customer Churn with Voice of the Customer Data

Voice of the Customer (VoC) data is a treasure trove of insights that can fuel a robust churn risk model. By carefully analyzing customer feedback and behavioral patterns, you gain the power to anticipate potential churn and take proactive measures to improve customer retention.

Here's how to translate Voice of the Customer data into actionable churn reduction.

Step 1: Identify Data Points that Predict Customer Churn

Start by examining various sources of voice of the customer data to pinpoint the signals that often indicate that a customer is at risk of leaving. Consider these key indicators:

- Website/App Engagement: Look for drops in session frequency, time spent on site, or specific page abandonment that suggests waning interest.

- Negative Reviews & Feedback: Negative feedback in reviews, surveys, or support tickets is a warning sign. Sentiment analysis tools can uncover dissatisfaction even within feedback that isn't explicitly negative.

- Increased Support Interactions: Spikes in support requests, particularly those related to product issues or frustrations, may indicate that customers are struggling or considering alternatives.

- Purchase Frequency Changes: Significant shifts in purchase patterns, such as longer gaps between orders or decreased spending, suggest a customer may be drifting away.

- Specific Sentiment: VoC analysis tools help identify recurring keywords or phrases associated with churn, such as "frustrated," "complicated," or "considering alternatives." AI-driven sentiment analysis can identify patterns and themes more accurately and offer instant actional insights.

Step 2: Create a Predictive Model

Analyzing your historical churn data is essential for building your predictive model. Examine the behavioral patterns and feedback trends present in past churned customers. This analysis allows you to assign weights to specific data points based on how strongly they correlate with churn.

Develop a churn risk scoring system that incorporates these findings. It will allow you to identify customers at varying levels of risk proactively. Predictive modelling tools or statistical analysis techniques can further refine your model and improve its accuracy, but remember—the insights gained from VoC data provide the foundation.

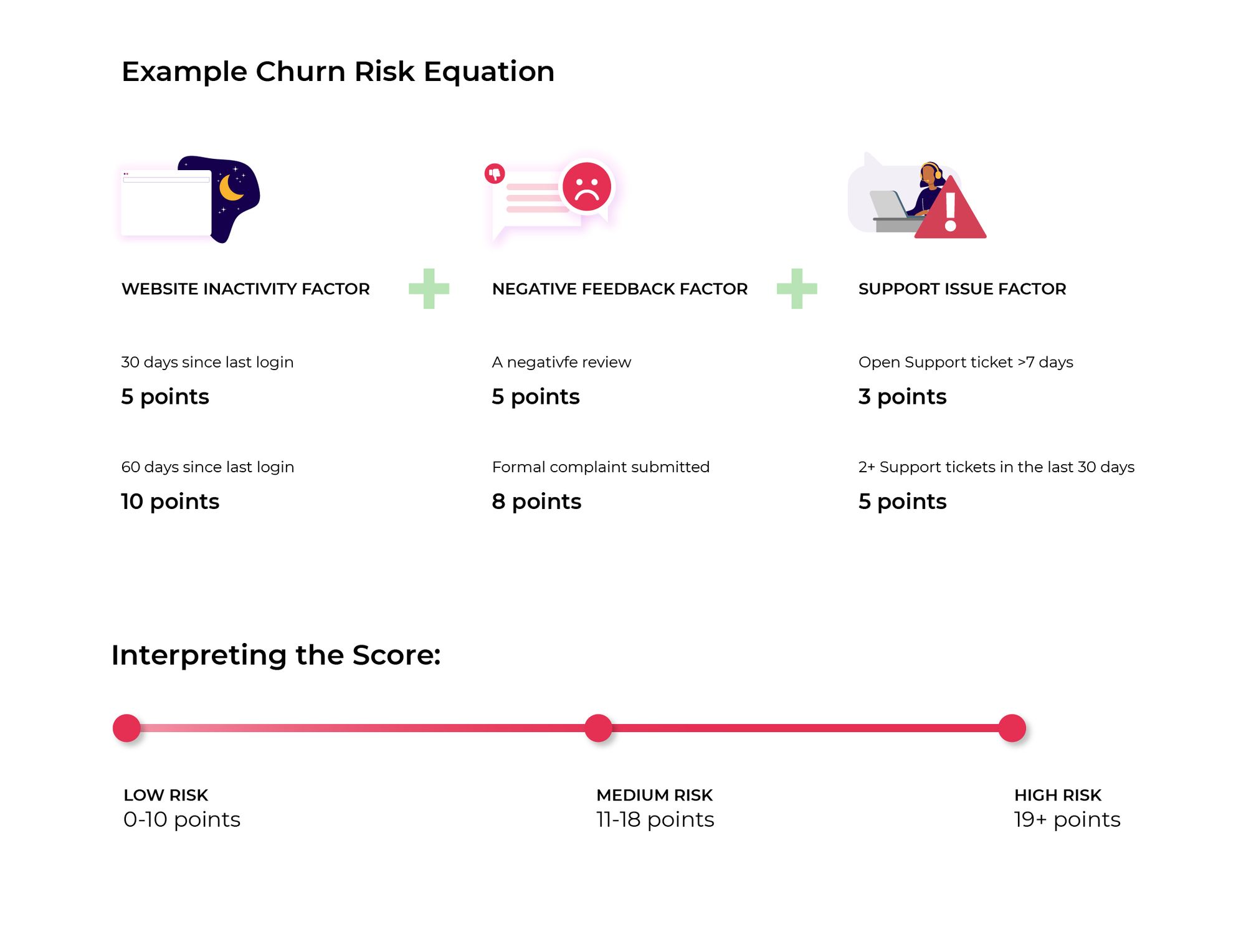

Example Churn Risk Equation

Churn Risk Score = (Website Inactivity Factor) + (Negative Feedback Factor) + (Support Issue Factor)

Where:

- Website Inactivity Factor:

- 30 days since last login = 5 points

- 60 days since the last login = 10 points

- Negative Feedback Factor:

- A negative review (1-3 stars) = 5 points

- Formal complaint submitted = 8 points

- Support Issue Factor:

- Open support ticket > 7 days = 3 points

- 2+ support tickets in the last 30 days = 5 points

Interpreting the Score:

- Low Risk: 0-10 points

- Medium Risk: 11-18 points

- High Risk: 19+ points

Important Notes:

- It is a simplified example. Your equation should be tailored to your business's most relevant data points.

- The point values and risk thresholds must be calibrated based on your historical churn data and business goals.

- Consider using weights to emphasize the relative importance of certain factors.

Step 3: Customer Segmentation Based on Risk

Not all at-risk customers are at the same stage of disengagement. Segmenting your customer base by risk level allows you to tailor interventions and resources effectively. Here's a basic example:

- Low Risk: Customers showing minimal potential churn might require general engagement strategies.

- Medium Risk: These customers exhibit concerning behavioral changes or negative sentiment, requiring targeted outreach.

- High Risk: These customers show strong predictors of imminent churn and prioritized proactive interventions or personalized offers would make a difference.

Step 4: Target At-Risk Customers with Personalized Interventions to Prevent Customer Churn and Enhance Customer Experience

Harnessing the power of the Voice of the Customer (VoC) can proactively prevent customer churn and elevate the overall customer experience. Segmenting customers by risk level lets you personalize your interventions for maximum impact.

Proactive Outreach Strategies

- Low Risk: General engagement campaigns can subtly address churn risks by highlighting content or offers relevant to common customer pain points revealed by VoC data.

- Medium Risk: Targeted outreach is key. Personalized emails or in-app messages referencing the customer's specific feedback demonstrate active listening and a commitment to improving the customer experience.

- High Risk: Prioritize proactive solutions to prevent customer churn. These customers require tailored outreach that offers immediate value, such as potential solutions, exclusive support, or personalized incentives.

Voice of the Customer (VoC) data illuminates the "why" behind customer churn risk. Use these insights to fuel positive change and improve the overall customer experience:

- Product/Service Improvements: Address product flaws, confusing workflows, or feature gaps that drive customers to consider alternatives.

- Optimized Onboarding: Streamline the onboarding process based on common frustrations uncovered by Voice of the Customer data to prevent early churn and enhance new customers' experience.

- Pricing and Value: Is price sensitivity an issue? Voice of the Customer insights informs pricing adjustments or strategies for effectively communicating the value proposition to specific customer segments.

A customer struggling with complex software might receive proactive support offers (Medium Risk), while a high-risk customer expressing frustration might be offered a discount paired with a dedicated training session.

Sometimes, a well-timed offer or gesture can be the deciding factor for a customer considering leaving. Loyalty programs or targeted incentives can help retain higher-risk customers and demonstrate your commitment to providing a positive customer experience.

Here are some strategies informed by Voice of the Customer (VoC) insights:

- Personalized Discounts: If VoC data reveals price as a primary driver of churn risk, targeted discounts or special offers can showcase your product or service's value, encouraging customers to reconsider.

- Exclusive Perks: When declining engagement is a concern, exclusive perks like additional features, access to content, or personalized support can reinvigorate the customer's interest and prevent them from seeking alternatives.

- Early Access or Special Trials: Based on VoC feedback, engage enthusiastic but potentially frustrated customers by offering early access to new features they've expressed interest in. This shows you're listening and invested in meeting their needs.

Step 5: Win-Back Campaigns Informed by Voice of the Customer

Even with proactive churn prevention efforts, there are times when customers leave. However, VoC data can be a powerful tool for winning them back. By understanding the reasons behind their departure, you can create targeted and personalized win-back campaigns that resonate with these lapsed customers.

Start by reviewing the feedback provided by churned customers. This valuable data can be found in:

- Exit Surveys or Reviews

- Past Support Tickets

- Direct Outreach

Voice of the Customer data helps you move beyond generic "we miss you" win-back campaigns. By tailoring your offers and messaging to why customers left, you significantly increase your chances of re-engaging them.

Generic win-back campaigns often fall flat. Voice of the Customer (VoC) data allows you to ditch the one-size-fits-all approach for targeted outreach. Demonstrate that you've listened to churned customers by referencing their past feedback in your win-back efforts.

Directly address their concerns, showcasing that you're committed to improving their experience. Additionally, segment your audience based on common reasons for leaving. This will ensure your win-back offers are relevant and resonate with specific groups of churned customers.

Step 6: Measure the Impact of the Voice of the Customer on Churn Reduction

Implementing a VoC-driven churn reduction strategy is an investment, and tracking the results is crucial. By defining clear success metrics and showcasing the return on investment (ROI), you can demonstrate the value your VoC program brings to the business.

While overall churn rate is important, go deeper to understand the true impact of your VoC initiatives. Track the following:

- Changes in Risk Scores: Monitor how the average customer churn risk score changes over time. A decrease demonstrates the effectiveness of your proactive, VoC-informed interventions.

- Win-Back Success Rates: Measure the percentage of churned customers successfully engaged and re-acquired using your VoC-driven win-back campaigns.

- Improvements in Key CX Metrics: Track how customer satisfaction scores (CSAT), Net Promoter Score (NPS), or other relevant customer experience metrics change alongside your churn reduction efforts.

Present a compelling business case for your VoC program by highlighting the financial and ROI impact. It could include:

- Case Studies

- Reduced Churn Costs

- Increased Customer Lifetime Value (CLV)

- Changing sentiment trend

Step 7: Foster a Culture of Customer-Centricity

Truly leveraging VoC for churn reduction goes beyond tools and analysis. It requires embedding customer-centric thinking into the fabric of your organization. Here's how:

- Share Insights Widely: Don't silo VoC data within a single team. Make insights accessible across departments, ensuring everyone understands the direct impact of customer experiences on churn.

- Celebrate Successes Driven by VoC: Publicly recognize employees and teams who champion VoC initiatives and achieve significant wins in improving the customer experience.

- Empower Frontline Staff: Provide frontline team members with the tools and training to capture valuable customer feedback. Encourage them to escalate recurring issues and suggest solutions based on their observations.

- Close the Feedback Loop Internally: Just as you close the loop with customers, demonstrate commitment by transparently communicating internally about changes and improvements based on Voice of the Customer feedback.

A customer-centric culture only happens after a period of time. By consistently sharing VoC insights, celebrating wins, and empowering employees at all levels, you create an environment where preventing churn and enhancing customer experience becomes a shared mission across the company.

Put Customers First with Voice of the Customer: Reduce Churn, Boost Customer Experience

Churn quietly erodes your bottom line and damages your hard-earned reputation. Every lost customer represents missed recurring revenue and the potential for negative word-of-mouth that can deter future customers. The financial and reputational costs are simply too high to ignore.

Voice of the Customer (VoC) transforms your approach. It's the key to shifting from reactive customer service to proactive churn prevention. By systematically analyzing customer feedback, you gain insights into the root causes of dissatisfaction and take action before customers head for the exit.

Are you ready to stop guessing and truly understand the "why" behind churn? Thematic is here to help. Unlock the actionable insights hidden within your customer feedback and proactively improve the customer experience. Begin your journey with a guided trial of Thematic and discover the power of the Voice of the Customer in action.

Stay up to date with the latest

Join the newsletter to receive the latest updates in your inbox.