The Complete Guide To Product Feedback Strategy

Whether your product is a vacuum cleaner, a mobile app, or a SaaS solution, product feedback should drive decision-making. Sadly, this feedback is often not analyzed and even when it is, the insights are rarely acted on.

I spent the last 5 years building Thematic, a customer feedback solution. After speaking to hundreds of customer analytics and insights professionals about their feedback strategy, here’s what I’ve learned:

- Companies have unprecedented volumes of feedback sitting on their servers, and they continuously ask for more.

- However, there are no great best practices for what to do with that feedback. So each team invents their own approach, with varying results.

- Product teams that translate feedback into action do so by turning an overwhelming flood of feedback from disparate channels into a product feedback loop that aligns people, processes and technology in a way that is responsive to customer needs.

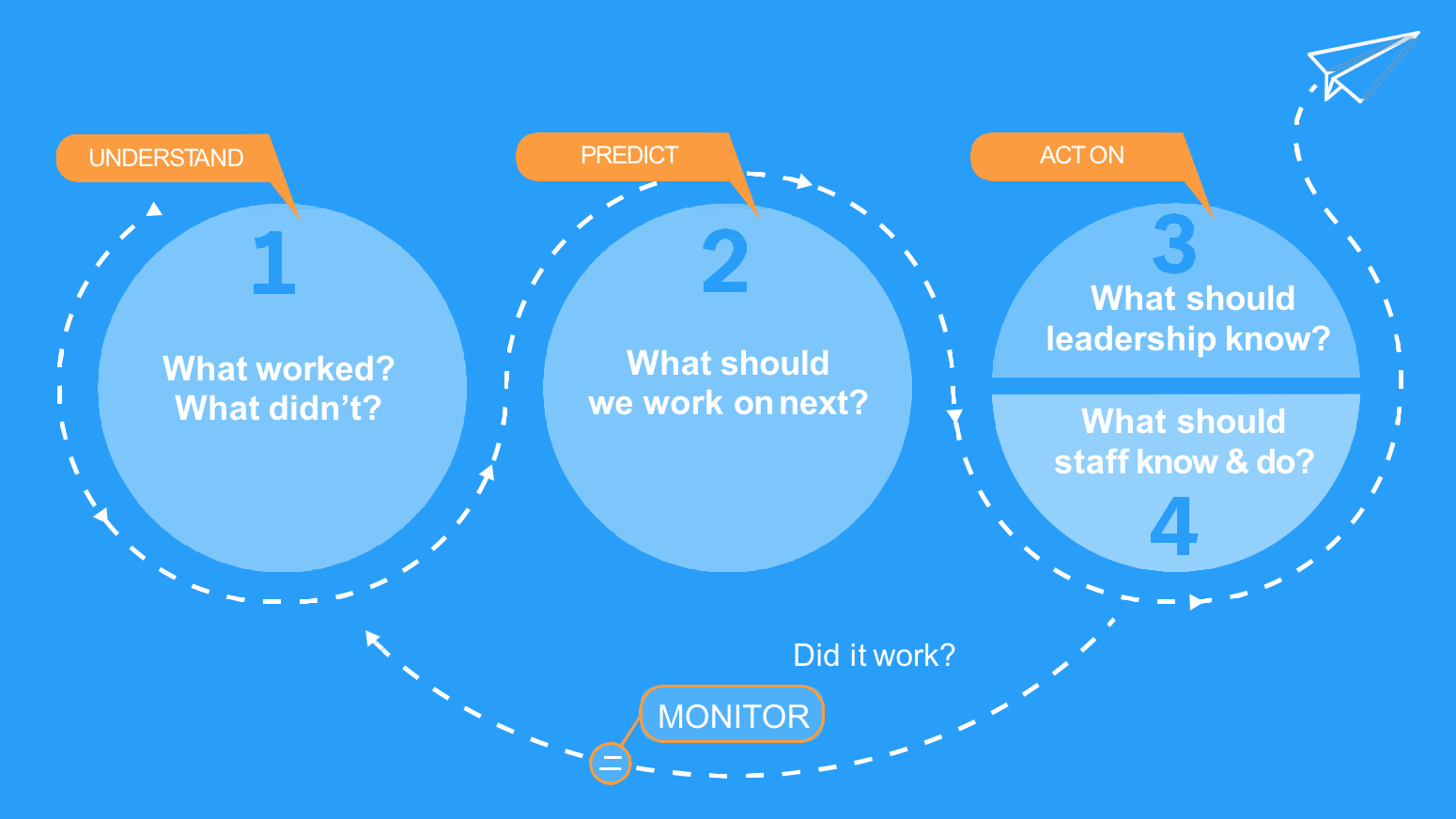

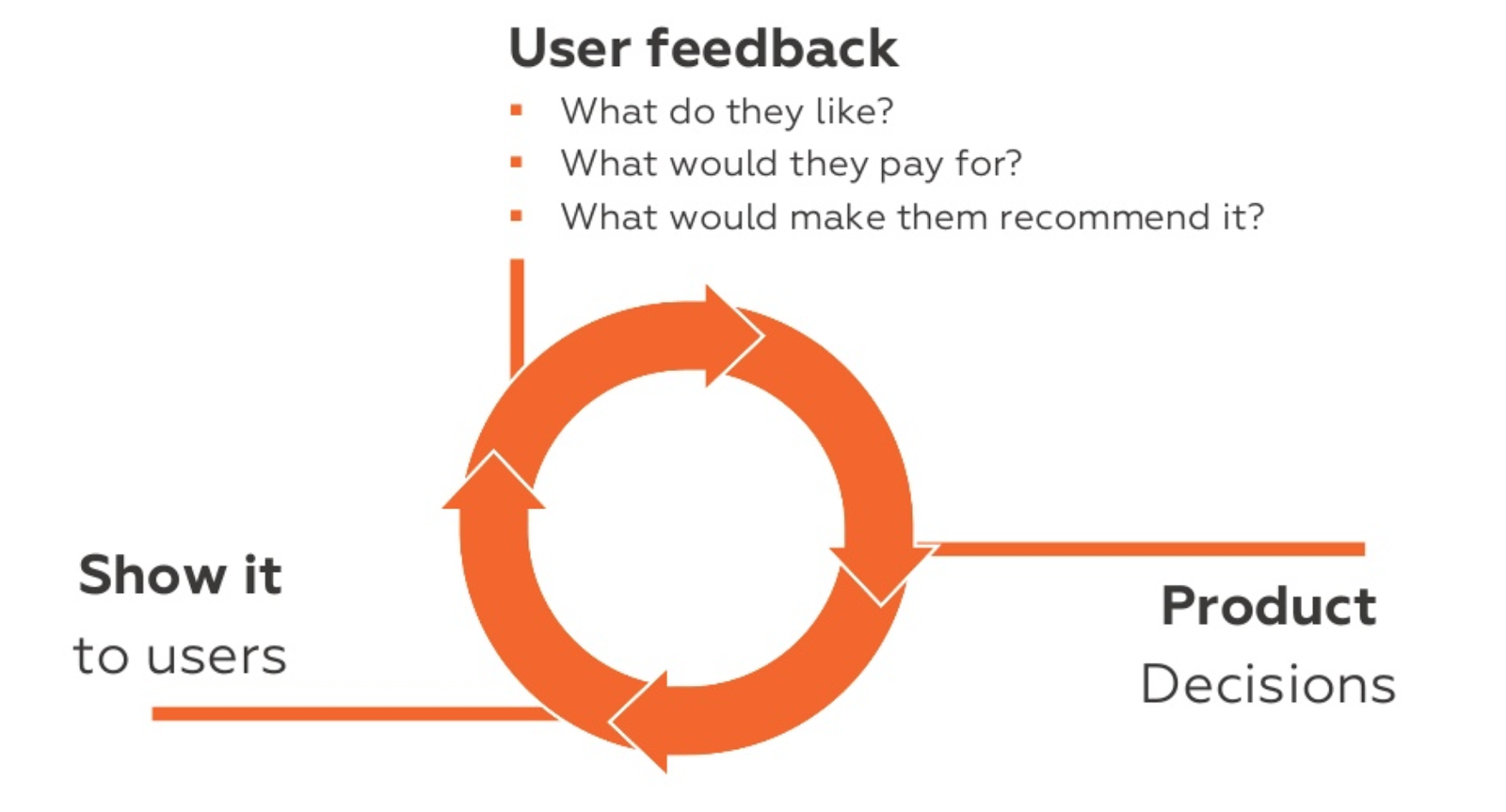

Here's how a product feedback loop works:

In this post, we'll discuss how to collect, analyze and share product feedback, so that you and your product team can make customer-driven decisions.

Part 1: Collecting product feedback

Let’s look at how we collect customer feedback.

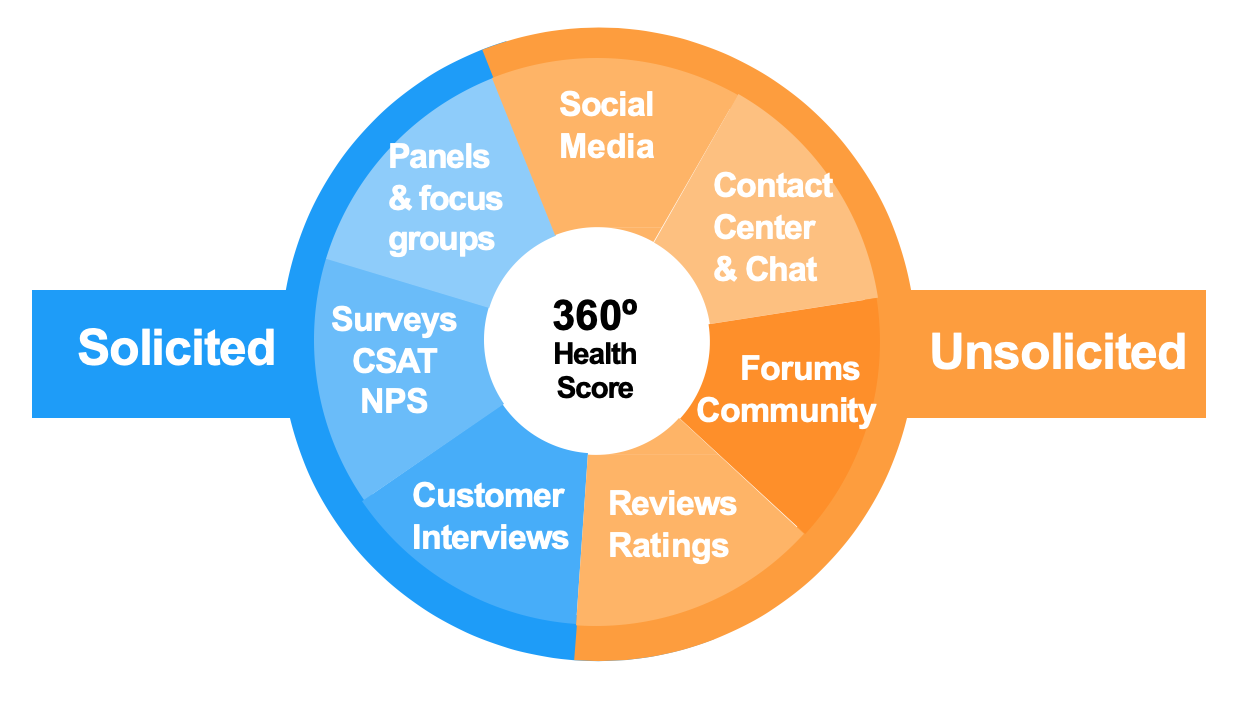

Product feedback can be solicited or unsolicited. Feedback is solicited when you specifically ask for it , and unsolicited when others provide it of their own accord. For example, when they leave a review online or tag your company on Twitter.

To get a full picture of your customer experiences you need to include both types of feedback from as many channels as possible.

Solicited product feedback

Solicited feedback can be quantitative (ratings, scores), or qualitative (text). It allows you to ask the questions you feel are most important to improving your product.

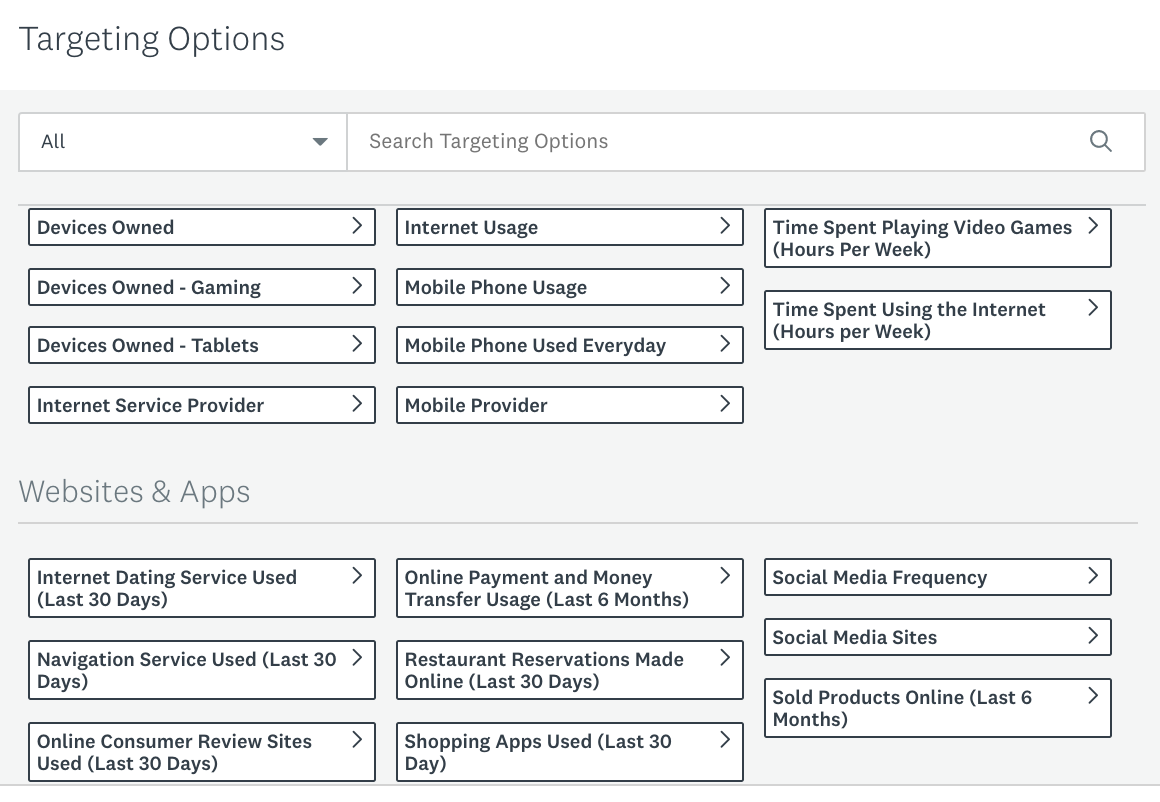

Some of the targeting options on SurveyMonkey Audiences

Customer surveys

Customer feedback surveys help keep your finger on the pulse. Feedback is continuous, fast and specific.

- The most popular are Net Promoter Score (NPS), which measures loyalty, and Customer Satisfaction (CSAT) feedback surveys.

- The Product Market Fit survey is particularly useful for new products due to its key question: “How would you feel if you could no longer use the product?”

If you are in a highly competitive space, companies like ROIRocket provide double-blind NPS surveys to get deeper insights.

Pros: Easy to setup, cheap, and scalable with the right survey tools. Most aren’t anonymous and you can link customer metadata to feedback.

Cons: Survey fatigue, low response rates, bias towards respondents. Insights vary depending on customer engagement and the quality of your survey.

Tip: Make customer feedback surveys work for you by ensuring you have a system in place for the analysis of survey feedback. Then, if you have a specific question, you can check this feedback first. It can also be a starting point for deeper customer interviews.

Customer interviews, panels & focus groups

Respondents don't tend to expand on their answers in customer surveys. With customer interviews, you can dig deep into specifics.

Focus groups are like customer interviews, except many people take part. These can be your pre-selected customers or you could use a panel. They can be virtual, or automated using solutions like Remesh.

Pros: Great for deep insights into specific issues. Particularly useful for discovering unknowns about new products or new product features.

Cons: Not scalable, expensive and difficult to analyze the results.

Tip: Customer interviews work best when you target users who care about the topic. Find customers who are commenting on the issues you want to explore and invite them to interview.

Unsolicited product feedback

Unsolicited feedback is qualitative, text-based and requires effort to gather, categorize and analyze. But it’s worth it.

Communities and forums

Communities and forums can be either solicited or unsolicited, depending on the set up. For example, if a community emerges on a public forum like Reddit or Discourse, it's unsolicited feedback. But if you create a community using a tool like UserVoice, then it's solicited.

Pros: Unmoderated and unfiltered, providing the most truthful feedback. Public content in communities can be indexed by search engines.

Cons: Unstructured and anonymous, and might not work for all types of products. Biased towards those who are most active in the forum.

Tip: Make online forums work for you by starting with existing communities. Know where you and your competitors’ users talk about your products.

Contact centers, support & complaints

Today when customers need help, they have many options:

- Call a help line or a call center

- Use a live chat or a bot

- Raising a support ticket

- Emailing or complaining on social media

These requests are a great source of product feedback. They show what’s not working, and also which features customers care about.

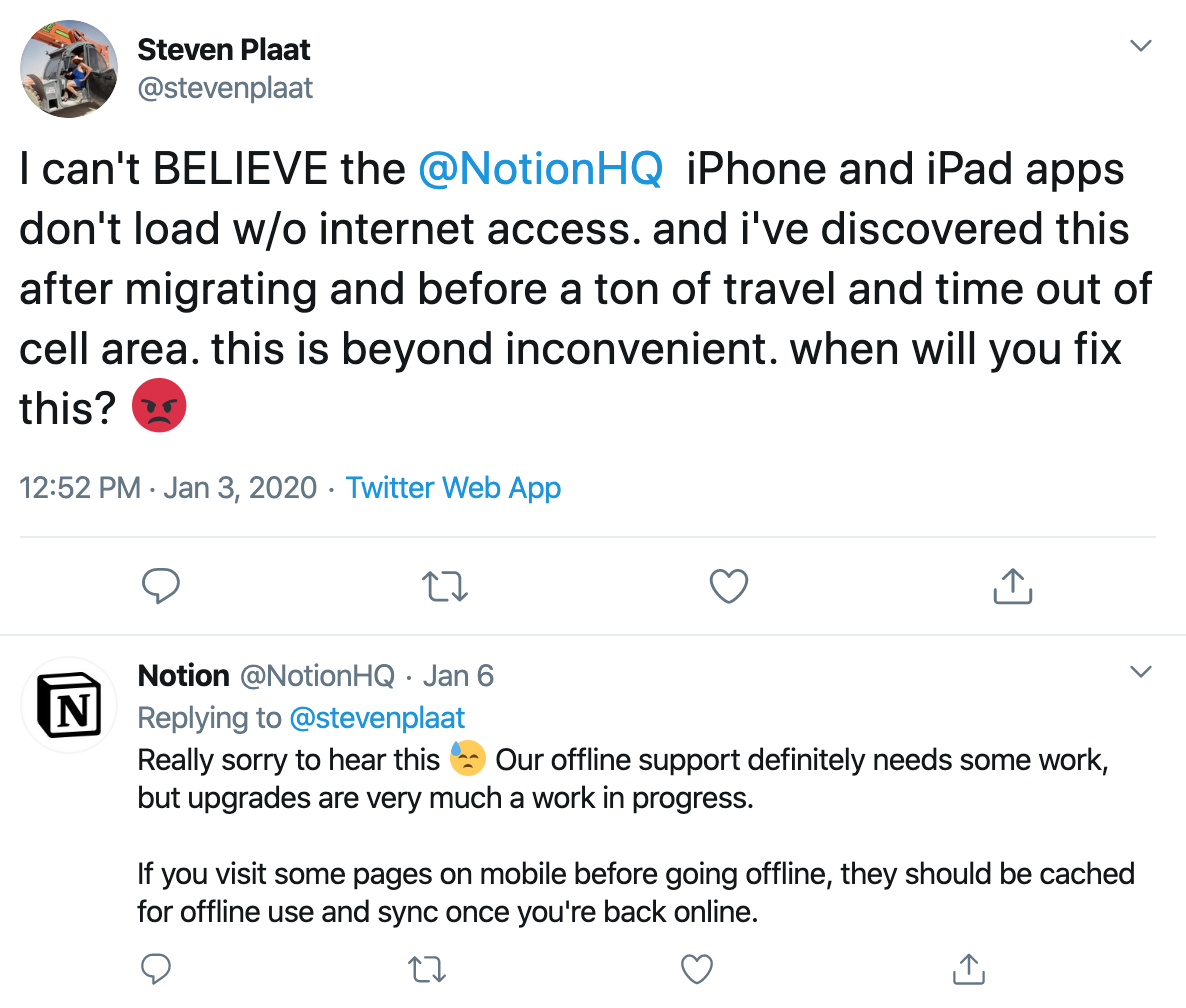

Example of unsolicited feedback on Twitter

Pros: You already have this data as part of support and customer service operations. Customer metadata is available for each piece of feedback via ids, unless it’s social media requests.

Cons: Feedback may refer to aspects of service, so you'll need a way to filter this out.

Tip: Don’t only respond to support tickets. Use this data strategically and know how to prioritize fixes.You’ll improve your product and reduce support costs at the same time.

Online reviews

In most cases, customers provide unsolicited reviews of products they care about. Choose the review sites most relevant to your product type.

Some examples:

- Google play and iOS AppStore for app reviews

- Trustpilot for B2C products

- G2Crowd and Capterra for B2B products

- Amazon and other e-Commerce platforms for review of physical (and digital) products

- Google or Tripadvisor for reviews of hotels, restaurants, and sights

- Booking.com for reviews of hotels

- Facebook and Instagram for reviews of local businesses

Pros: Some structure (they have scores!), feedback of both your and your competitors’ products.

Cons: Reviews can be fake or biased, and are anonymous. Often short and not actionable.

Tips: Find a solution or integration that unifies and gathers reviews in one place for easy comparison between you and your competitors, ideally with trends over time.

Take a look at what your competitors’ customers are saying! Include their reviews in your product feedback loop to find competitive gaps to fix or exploit.

Part 2: How to improve your product feedback strategy

Let’s talk about what to do with all that feedback!

You likely have a strategy in place to analyze feedback, but it may be incomplete, outdated or not scalable. Product feedback strategy is like pricing strategy: it needs to evolve with the company.

As you scale, make sure feedback is collected, analyzed and shared efficiently with your product team. Ensure you have an effective product feedback loop, and consider feedback at all life cycle stages of the product development.

Choose the right product feedback tools

The most common product feedback tool is a spreadsheet! Spreadsheets unify feedback across many different channels; Some use AirTable for this purpose.

Other options include data warehouses like AWS Redshift and company wikis, like Confluence and Notion. Some companies use Jira boards to submit customer requests for product features.

Specific feedback SaaS offerings we’ve seen are ProductBoard, Aha! and DoveTail. Feedback is limited to customer interviews or inbound requests, and has to be tagged by hand. A lot of unsolicited feedback, including online reviews and support tickets, isn't captured.

All the above solutions require manual organization and analysis. Wading through huge amounts of customer data is incredibly time-consuming; it’s hard to tag every single piece of feedback, and it can be biased too!

But there are other solutions, like Thematic, which gather and analyze your feedback using a combination of Natural Language Processing and human input, ensuring accurate and relevant analysis.

Let's take a look at how you can analyze your feedback effectively.

Design an effective product feedback loop

Aggregating feedback in one place isn’t enough. You need a process that turns feedback into actionable insights to drive product development and improvement. We also need to make sure customers are aware of the changes you are making.

Here is an example of an internal product feedback loop: You gather feedback, then turn it into insights, identifying drivers of customer satisfaction, loyalty, and differentiation from competitors. You then share these insights with your product teams, and continue to gather feedback by showing your updated product to users.

How to Build a Startup by Sam Altman

Customer feedback provides insights into customer needs, and helps create more scalable operations. By fixing issues, you can continuously reduce costly customer support requests.

Don't forget to follow-up with customers! Telling customers how you’ve addressed their feedback encourages customer loyalty, and makes it more likely they'll share feedback on their user experience in future.

Before improving your company’s product feedback strategy, consider these questions:

- Who needs to be involved in gathering feedback and how?

- What stakeholders are involved in product decisions, what metrics are they responsible for, and what data (such as churn, growth, or operational costs) do they use?

- How will you tie customer feedback to those metrics and data sources?

- How will you share insights with others? And how often?

- What’s the best way to follow up with customers about changes we’ve made as a result of their feedback?

Part 3: Analyzing product feedback

Analyzing customer feedback in a consistent and accurate way is difficult, and the reason why I co-founded Thematic. Here are some challenges that you might not have considered:

- It takes a long time to code feedback by categories, tags or themes.

- Customer feedback is only one part of the picture! You will need to link your feedback with product analytics in a meaningful way, and include other relevant metrics and data sources.

- Visualizing this data is tricky. Customers are likely to mention between 50 and 500 distinct themes in their feedback, depending on the product.

So, how can you practically solve these challenges?

Here is our 4-step approach.

Step 1: Turn qualitative feedback into quantitative data

Organize feedback based on what customers are actually saying. If you’re tagging feedback manually, make sure to keep track of your tags so that you don't end up with duplicates.

There are different approaches to organizing and automating feedback analysis, which we’ve covered in previous posts. Depending on the size of your company, one of these might resonate:

- How to build a text analytics solution in under 10 minutes

- 5 approaches to text analytics – text analytics methods used by companies today

- Build your own customer feedback analysis solution

If you choose to analyze feedback manually, beware of bias! It’s easy to see what you’re looking for and miss what actually matters to customers.

Tip: Don’t create tags in advance of reading feedback. Whether you use a manual or an automated solution, make sure your themes and tags emerge from the data itself.

Step 2: Link product feedback to behavioural and demographic customer data

Not all feedback is equal. Looking at common themes by volume won’t provide the most accurate insights. Link each piece of feedback to as much information (such as demographic, behavioral, CRM and operational data) as possible:

- Is your customer new, old, existing or churned?

- What did they buy from you and who is their account manager?

- How much do they spend with you and how often do they use your product?

- What are the NPS ratings they’ve provided (or any other ratings/scores for that matter)?

- Where are they located?

- How did you acquire them and how much did it cost?

- If appropriate to your product type, what are their demographics?

Tip: Consider all aspects of who your customers are. Dig deep to find attributes you might not have considered.

Step 3: Visualize data effectively

There are two most common ways of visualizing product feedback and I’m not a fan of either. The first version recently got featured in a document that landed on my desk: the quote!

This is an equivalent of a vanity metric in product analytics.

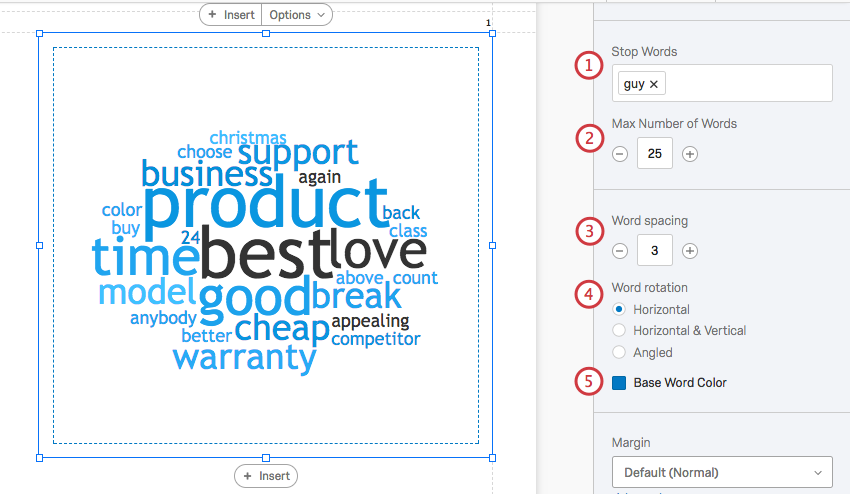

The second one is our not so beloved word cloud.

An example of a word cloud maker in Qualtrics

Neither method is effective or accurate, and they're easily dismissed or taken out of context.

It doesn’t have to be this way!

We’ve written an article on alternatives to word clouds and better ways of visualizing feedback.

To summarize its key points:

- Use themes instead of keywords

- If in doubt, use a bar chart and use relative numbers rather than absolute numbers.

Tip: The most effective visualizations are those that answer a specific question. We’ll cover the best questions to ask using product feedback in the next section.

Step 4: Be thorough and consistent over time

Feedback analysis is often done in reaction to urgent projects and deadlines. When this happens, limited customer feedback is analyzed, and the results are rarely useful for future projects.

Instead of wasting your time with ad-hoc analysis, be consistent and thorough in your theme identification. An entirely different class of insights will emerge, and it will be easier to answer questions that crop up in future.

Tip: If you’re stuck in spreadsheets and don’t think you could justify the investment in a solution (like Thematic!) that would automate the analysis process, check out our post on The True Cost of Not Understanding Customer Feedback.

Part 4: How to share product feedback with others

Who should care about product feedback? We think everyone!

Let’s look at why your product team might need product feedback to meet their goals.

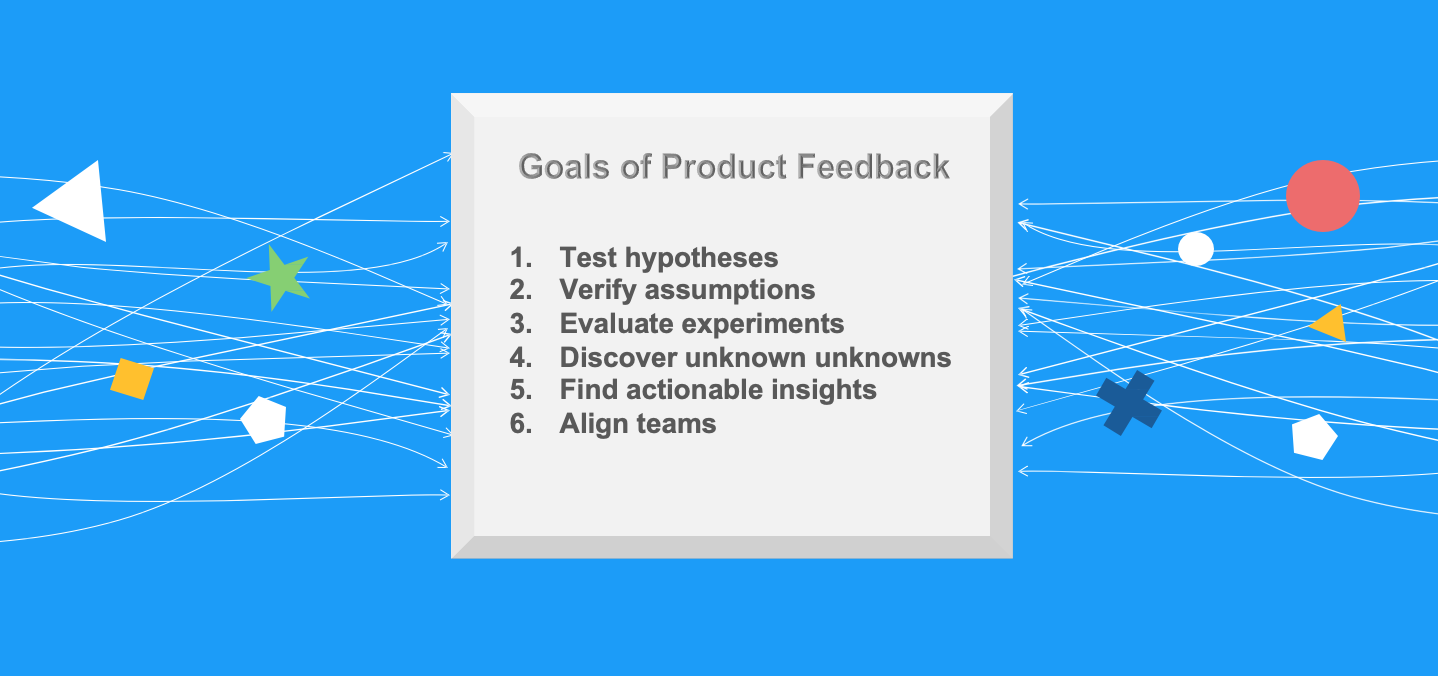

Align insights with stakeholder goals

If gathered, analyzed and visualized correctly, feedback should support company goals by:

- Testing hypotheses, e.g. we think that users in category A are more interested in B

- Verifying assumption, e.g. I believe our customers value C above all else

- Evaluating experiments, e.g. do customers see our D as positive after we changed it?

- Discovering unknown unknowns, e.g. an emerging competitor or a sudden bug

- Finding actionable insights, e.g. when customers struggle with feature E

- Aligning teams, e.g. making sure that everyone knows what drives KPIs such as NPS

Pretty much every team in the company benefits from this supporting data. But it’s up to you to convince stakeholders that insights will help the company and the customer.

Tip: Our webinar “Proving the ROI of CX” has 5 keys for turning insights into action and influencing stakeholders. Check it out for ideas on how to turn feedback into insights that will matter to stakeholders at all levels.

Sharing feedback with others

You need ways to share your insights that make them easy to understand. Examples include slide decks, weekly print outs and desk drops, email updates and dashboards.

Create an internal customer journey map by listing the different stakeholders involved in turning your insights into action.

List their priorities, metrics that matter most, and how they consume information. You'll be able to see how to produce the insights they need in a format that's helpful.

Here are a few examples of ways that feedback can be shared:

Lifecycle Events

Every organization has weekly, monthly, quarterly and yearly cycles that center around meetings. These are your key windows for delivering feedback for maximum impact. Identify which meetings are most important, and ask contributors what would be helpful for you to share.

Ad-hoc queries

Several times a month, product managers and their teams will receive questions that support the goals of various teams. Typically, they want to test a hypothesis or evaluate an experiment. Their questions might be:

- I think I should work on X. Is X a problem? How badly does it affect our key metric, how many customers talk about this, and what’s the overall trend?

- We have done some work to Y, did customers notice? Has the impact of Y on our key metric increased?

Make sure your visualization toolkit includes charts and graphs to support these questions.

Regular updates to align the team

Most companies review their key metrics monthly or quarterly. Make sure your update answers the following questions:

- What’s our key metric and what was it last time?

- If it went up, why? If it dropped, why?

- What impacts this key metric overall, and for our key customers?

- If you have departments, teams or location, which one has the best results and why?

Customer in the room

For any product roadmap meetings, make sure customers are in the room. Sure, you won’t have your actual customers there, but it’s important they are represented through their feedback.. Your team will be able to look up whatever they are addressing right at that moment and access valuable insights. Follow up with customers who provided the relevant feedback to learn more.

Amazon’s Jeff Bezos has an empty seat at his company meetings that is designed to represent the voice of the customer. A symbolic gesture to assure that the customer is always represented and considered in decision making.

DIY / Self Service

One of the things I love hearing from our customers is that they no longer feel like a bottleneck for questions and answers. When product feedback is analyzed thoroughly and consistently and is made easily accessible to anyone in the organization, it takes on a life of its own.

Seeing multiple stakeholders across the company using a central source of customer feedback just feels right.

In conclusion

Product feedback has traditionally been seen as anecdotal, unscientific and mushy.

This article shows that it doesn’t have to be this way.

With the huge volumes of feedback already available to most companies, you should know who your customers are and what they like and dislike.

Using the latest tools and solutions, analysis and sharing can be streamlined so that you can answer questions quickly and accurately.

The most amazing thing: If we hear and act on what our customers are telling us, everyone will benefit! We’ll see better customer retention, marketing via word of mouth and, ultimately, more profitable business.

Stay up to date with the latest

Join the newsletter to receive the latest updates in your inbox.