From Ignored to Indispensable: The Proven, Step-by-Step CX Insights Mastery Blueprint in < 6 Days! Get free access>

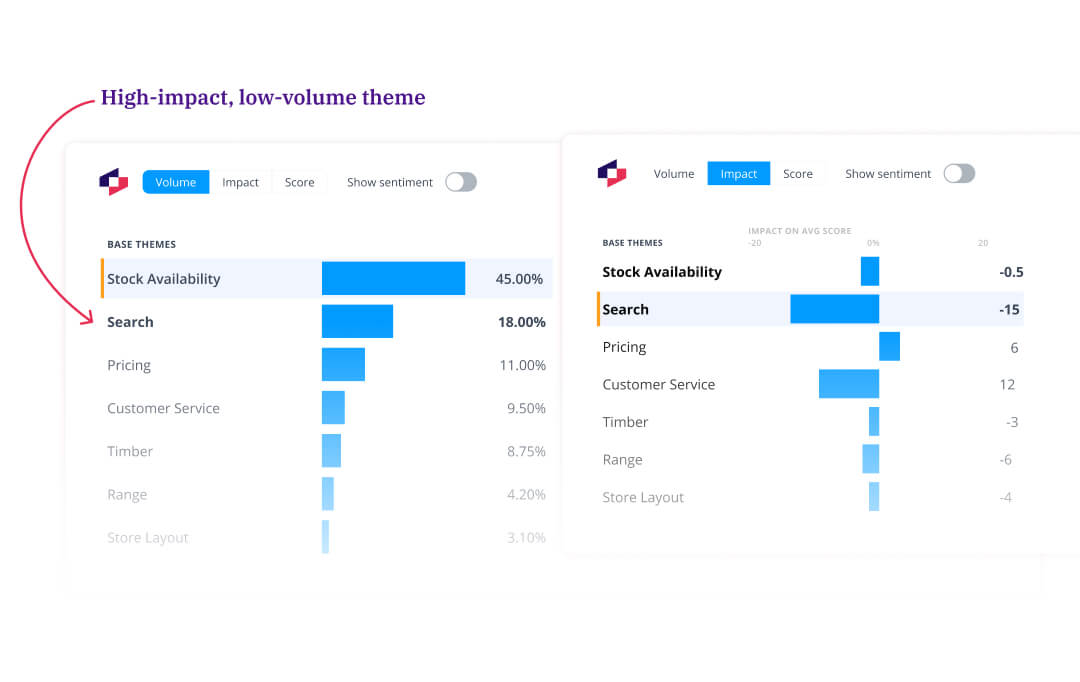

Your enterprise and SMB customers don't experience the same problems the same way. A complaint from 8% of enterprise accounts can cost 15 NPS points, while a complaint from 45% of SMB customers costs only 0.5 points. Learn the 3-step framework to stop prioritizing by volume and start prioritizing by segment-specific impact.

Your enterprise customers ($50K/year) and SMB customers ($500/month) don't experience the same problems the same way.

A complaint mentioned by 8% of enterprise accounts can cost -15 NPS points, while a complaint mentioned by 45% of SMB customers costs only -0.5 points.

This guide shows you how to stop prioritizing by volume and start prioritizing by segment-specific impact.

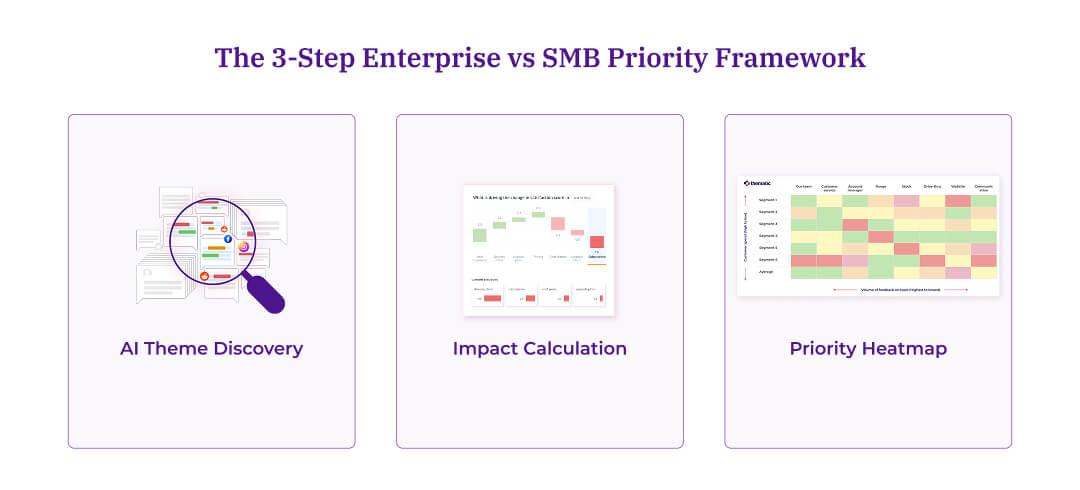

You'll learn the 3-step framework (AI theme discovery → impact calculation → priority heatmap) that helped Mitre 10 find $4.8M in opportunities, OrionAir gain 1.6 NPS points, and Greyhound cut analysis time from 3 weeks to 2 minutes.

Includes decision tables for prioritizing enterprise critical vs. SMB critical issues.

20,000 comments per month. 84 stores. Zero clarity on which segment was bleeding revenue.

Mitre 10 collected feedback across every channel. They had dashboards. They had processes. They closed the loop on complaints.

Yet their CMO (Chief Marketing Officer) couldn't answer one question: "What are our customers actually telling us?"

The problem wasn't volume. It was segmentation.

Their enterprise accounts (trade builders constructing homes from scratch, representing their highest-value customers) struggled with critical website issues that made product sourcing nearly impossible.

Meanwhile, their SMB customers (retail DIY customers) found the same website simple and easy to use.

Stock availability cost half an NPS point overall. But for enterprise trade customers building new homes, the impact hit harder, right when Mitre 10 was launching a new trade growth strategy.

Without segment-level analysis, leadership would have missed both insights entirely.

Keep reading to learn how to identify which segment complaints actually damage your business.

You’ll also learn:

Here is what surprised us when we analyzed feedback for Mitre 10, New Zealand's largest home improvement retailer.

They had done the "right" things. Comprehensive retail and trade feedback systems. Closed-loop processes. Brand alignment with "With You All the Way."

They were collecting 20,000 comments per month across 84 stores.

Yet their CMO still couldn't answer what customers were telling them. As she puts it: "I still don't feel like I know what's going on with our customers."

Their insights team couldn't read thousands of comments each month. Store teams had a feel for local feedback, but no coherent story emerged at the strategic level.

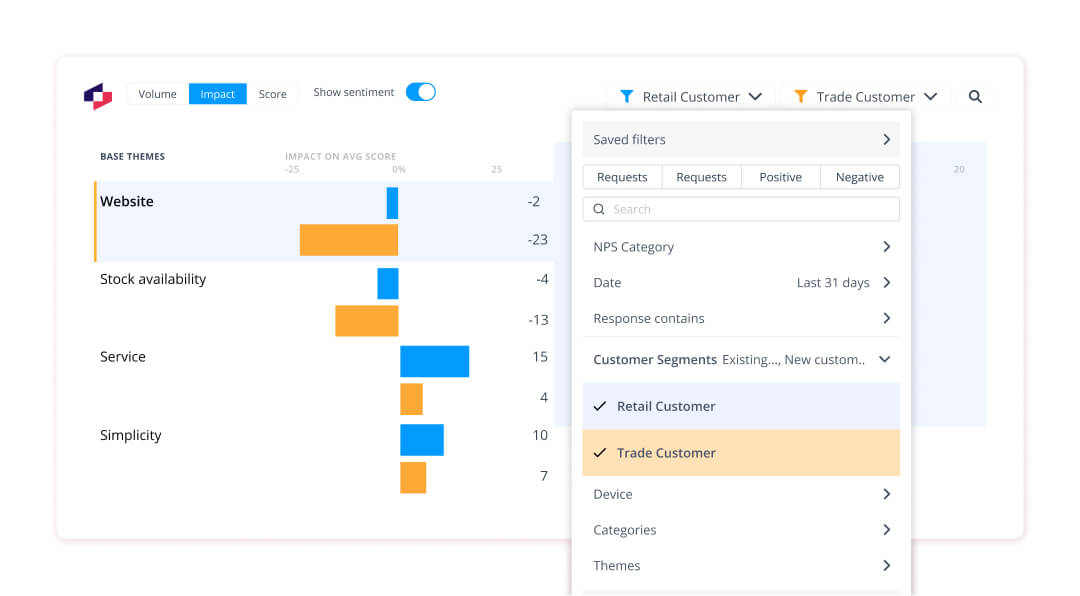

Once Thematic ran segment comparison analysis, the picture shifted:

The website was particularly problematic for builders constructing homes from scratch, their most valuable customer segment. For retail customers, the same website felt simple and easy to use, a clear strength to protect.

Stock availability cost half an NPS point overall, at the exact moment Mitre 10 was building a new trade strategy.

Stock availability wasn't just a noisy complaint. It was a strategic trade priority that supported a core commercial initiative.

"This insight helped us prioritize not just what to fix, but who we were fixing it for."

The lesson is simple: Your loudest segment complaint is not always your most important business problem.

Mitre 10's story is not unusual.

Across millions of feedback comments, we see the same pattern.

Teams treat all complaints the same way. A complaint from a $500 per month retail customer gets the same urgency as a complaint from a $50,000 per year trade account. Dashboards show aggregate themes and mention rates, but hide who is actually affected.

When you ignore segments, you see "product search issues: 8% mention rate" without realizing 95% of those comments come from your highest-value customers.

You spend roadmapping time on issues that may not move NPS or revenue. You keep fixing what is loud, not what is expensive.

The impact is immediate and measurable. It shows up in your budget, your timelines, and your churn.

Greyhound experienced this firsthand.

Before Thematic, their post-trip survey had 30-35 questions with long free-text responses. Manual feedback analysis took about 80% of one analyst's job and 3 hours to 3 days per cycle.

By the time results were compiled and shared, the data was already 3-4 weeks old. Station managers had no way to see issues that occurred outside 8 AM-5 PM office hours. As Matthew Schoolfield, Senior Customer Insights Analyst at Greyhound, explains:

"Previously, only one person, myself, would manually analyze the feedback. It was about 80% of my job, and would take me from 3 hours to 3 days. By the time we had manually compiled the results and sent them out, the data was already 3-4 weeks old."

After implementing Thematic's automated segmentation and dashboards, station managers in locations like New York can see comments for their station in near real time. They no longer need to email analysts or dig through 100-150 surveys per day to find issues.

Problems such as cleaning issues at specific terminals now surface within 2 minutes.

Schoolfield's summary is clear: "Thematic allows us to identify issues and distribute them to our station managers in real time. It's invaluable, as we can get the data into the hands of our employees easily."

This is what segment-aware, impact-aware analysis changes.

You stop acting on stale, aggregate data and start acting on live, segment-specific intelligence.

Once you understand the problem, the next question is obvious: How do you actually analyze segments in a way that leads to better decisions?

Most teams rely on three common methods.

Export feedback into CSV. Manually tag by customer type. Build pivot tables and charts to spot patterns.

This usually takes 2-3 weeks and depends heavily on analyst capacity and spreadsheet skills.

By the time you have answers, the opportunity has often moved.

Tools show mention rates and theme counts by segment. "Trade customers mention billing 23% of the time, retail customers mention it 18%."

This is a useful start, but volume alone does not tell you which complaints hurt NPS, revenue, or retention.

You commission a one-off deep dive. The report arrives 4-6 weeks later. The team has already moved to new priorities, and the insights feel outdated.

All 3 methods have the same flaw: they treat analysis as a slow project, not a live system.

What actually works is different.

Automated segment comparison that links specific complaints to business metrics for each customer type, in near real time.

That is how enterprise teams move from "interesting themes" to critical priorities.

Here is the simple 3-step approach our customers use to find their true priorities across enterprise and SMB segments.

Instead of manually categorizing thousands of comments, use AI to identify what each segment is actually talking about.

Mitre 10 imported feedback from multiple sources across its 84 stores.

Thematic's AI-powered theme discovery surfaced distinct patterns.

Trade accounts (enterprise customers) focused on website functionality and stock availability. Retail DIY customers (SMB segment) focused on service, local presence, simplicity, and ease.

Without segment separation, these nuances would be buried in aggregate scores.

Leadership would see "website is fine overall" and miss the fact that builders, their highest LTV segment, were struggling to complete key tasks.

Once you know what each segment talks about, the next step is understanding what actually matters to your business outcomes.

This is where most teams fail.

They assume high-volume complaints equal high-priority problems.

Two important insights stand out.

Website search issues were critical for trade (enterprise), but the same feature worked acceptably for retail (SMB).

Stock availability affected both segments, yet the impact on trade customers tied directly to strategic growth plans.

A similar pattern appeared at OrionAir, a leading low-cost carrier in the Asia-Pacific region.

After a system migration, dashboards showed a surge in generic service issues. It looked like the obvious focus.

Impact analysis told a different story.

Baggage handling was not the most frequently mentioned issue. It had a disproportionate negative impact on NPS and customer lifetime value. 80% of baggage-related problems were operationally fixable.

With this clarity, leadership shifted investment towards baggage handling improvements.

The results: 1.6-point NPS increase from baggage improvements alone, contributing to a 13% NPS increase overall. A measurable revenue boost from better retention and fewer negative experiences at a high-risk touchpoint.

OrionAir's insights team summed it up: "What's remarkable isn't just that we improved NPS. It's that we became more efficient in the process. Thematic helped us invest smarter, not just more."

The pattern is clear: The most frequent complaint and the most damaging complaint are rarely the same issue.

Data alone does not move a roadmap.

Executives need to see priorities in a format that makes decisions obvious.

This is where a segment-by-theme priority heatmap works well.

Structure it like this:

Mitre 10's heatmap made the story clear:

Critical (red)

High priority (orange)

Medium priority (yellow)

This visual did three things in one view.

The outcome:

Executives were not just told what to fix.

They could see who they were fixing it for, and why that sequence made sense.

Segment-based impact analysis is not an abstract framework.

Across customers, we see consistent, measurable outcomes.

Thematic has helped them humanize hardware, ensuring the voice of their customers informs every aspect of their business, from strategic planning to day-to-day operations.

Schoolfield's verdict: "Thematic is saving 50% of my time, it reduces my analytics time tenfold. This is the tool of the future for us."

Across these examples, the pattern is consistent.

Segment-level impact analysis turns feedback from a noise problem into a priority system.

To make segment prioritization systematic rather than ad hoc, you need a simple decision framework.

Use this two-axis grid to classify every issue:

From there, apply simple rules.

Priority rules

When choosing between enterprise critical and SMB critical, look at:

The goal is not to ignore SMB customers.

It is to match effort to impact segment by segment, instead of treating every complaint as equal.

Your enterprise and SMB customers do not experience your business the same way.

The same complaint from different segments can have completely different business consequences.

If you optimize for complaint volume alone, you overinvest in loud issues that have limited impact. You underinvest in quiet problems that silently erode your most valuable relationships.

A better approach: Stop optimizing for aggregate volume across all customers.

Start prioritizing by impact within the segments that matter most to your business.

The most important issues are rarely the loudest ones.

Your biggest opportunities often sit inside feedback from your highest-value segment, hidden in low-volume but high-impact complaints.

Thematic has helped companies like Mitre 10, Greyhound, and OrionAir move from "we have data but no story" to segment-level, revenue-aware priorities backed by quotes, metrics, and clear methodology.

See your own enterprise vs SMB impact analysis in 10 minutes. Book a demo with Thematic.

Join the newsletter to receive the latest updates in your inbox.

Transforming customer feedback with AI holds immense potential, but many organizations stumble into unexpected challenges.